Cash flow, inflow and outflow of cash, cash flow statements, cash flow analysis, cash management... if you manage your company’s finances, you need to understand and apply these methods — and more — to be successful.

Yes, there is a lot of information associated with mastering cash flow; however, we’ve created the following quick-study guide to help familiarize you with key topics, including:

- Why cash flow is critical to running a successful and sustainable business.

- How different cash flow types can signal your ability to grow and innovate, or to seek outside funding, or whether the business is overextended or operating with a healthy amount of debt.

- What are the indispensable metrics for benchmarking the health of your business.

- How cash flow analysis can help you identify under-performing revenue streams and the need for change, or if costs are rising higher than projected, the best ways to save money.

- Why cash management is essential to maximizing liquidity and minimizing the cost of funds.

- How to calculate cash flow.

- The answer to the million dollar question: Is profit different from cash flow?

SHORTCUTS

- What is cash flow?

- Why is cash flow important?

- What are the six types of cash flow?

- What is an inflow of cash?

- What is an outflow of cash?

- What is a cash flow statement?

- What is the main purpose of cash flow?

- How does the cash flow statement differ from the income statement and balance sheet?

- What is a cashflow forecast?

- What are the 3 types of cash flows by activities?

- What is cash flow analysis?

- Why is cash flow analysis important?

- What is cash management?

- How do you calculate cash flow?

- Is cash flow the same as profit?

- How is profit different from cash flow?

What is cash flow?

Simply stated: cash flow is the movement of money in and out of a company. Cash received represents inflows, while money spent represents outflows. Cash management includes how a company manages its operations, financial investments, and financing activities.

Why is cash flow important?

Cash flow is a measurement of how your company is doing by taking how much the company has made and subtracting the expenses.

Besides generating cash from its activities, a business also needs to manage its cash situation so that it has enough cash on hand to meet its immediate and long-term needs. A company’s survival depends on generating enough cash flow to cover its expenses, repay investors, and expand the business.

Here’s why cash flow matters: the more cash you have, and the closer your assets are to cash, the more liquid your business is. This is critical if you’re trying to secure funding as healthy free cash flows (FCF) can fuel management efforts to improve shareholder value.

A strong cash flow also means you’ll be in a better position to plan for growth, innovation, and related expenditures. In addition, your firm is more likely to deal with economic, competitive or operational challenges that occur in conducting business.

Discover how Treefrog gained clear visibility of their cashflow with Plooto.

Plooto’s fully integrated Accounts Payable, Accounts Receivable solution enables Treefrog, a digital transformation agency, to scale its business with confidence in cash flow. Previous systems created bottlenecks with a lack of visibility on the collections, timing, and assurance of the collections.

What are the six types of cash flow?

There are six types of cash flows used for financial analysis. They’re powerful tools to help you run your business and inform decision-making.

1. Cash Flow from Operations (CFO)

Cash flow from operations (CFO) describes money flows dealing directly with the production and sale of goods from regular operations. CFO indicates whether a company has sufficient funds flowing in to pay its bills or operating expenses. Meaning: there must be more operating cash inflows than cash outflows for a company to be financially viable in the long term.

Why 'cash flow from operations' matters: Operating cash flow indicates whether a business can:

- Generate enough cash flow to maintain and expand operations

- Seek outside financing for capital expansion

2. Cash flow from Investing (CFI)

Cash flow from investing (CFI) reports the amount of cash generated or spent from various investment-related activities in a specific period. Investing activities include purchases of speculative assets, investments in securities, or the sale of securities or assets.

Note: Negative cash flow resulting from large amounts of cash being invested in the long-term health of the company, such as research and development, is not necessarily a warning sign.

3. Cash Flow from Financing (CFF)

Cash flows from financing (CFF) show the net flows of cash that are used to fund the company and its capital. Financing activities include transactions involving issuing debt, equity, and paying dividends.

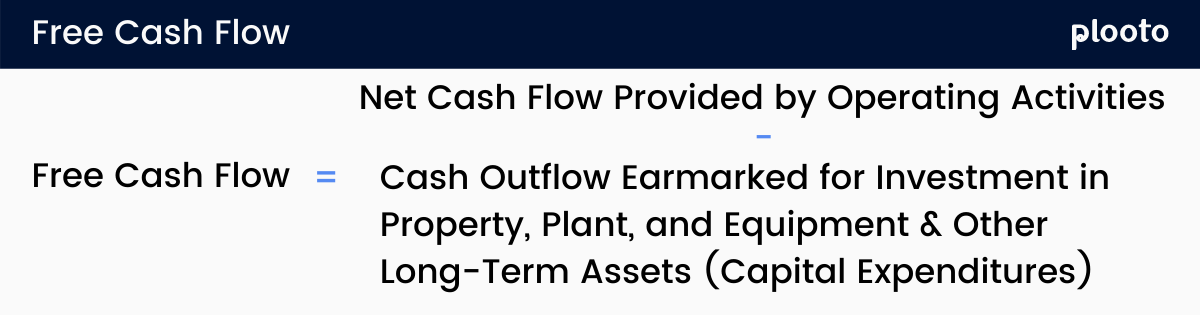

4. Free Cash Flow (FCF)

Free cash flow (FCF) shows the true profitability of a business. FCF shows what money the company has left over to expand the business or return to shareholders, after paying dividends, buying back stock, or paying off debt.

5. Unlevered Free Cash Flow (UFCF)

Unlevered free cash flow (UFCF) measures the gross FCF generated by a firm. It is the company’s cash flow excluding interest payments. UFCF shows how much cash is available to the firm before taking financial obligations into account.

Note: The difference between levered and unlevered FCF shows whether the business is overextended or operating with a healthy amount of debt.

6. Discounted Cash Flow (DCF)

Discounted cash flow (DCF) is a method used to estimate the value of an investment based on its expected future cash flows. DCF analysis attempts to figure out the value of an investment today, based on projections of how much money it will generate in the future.

What is an inflow of cash?

Cash inflow is the money going into a business. Cash inflow includes:

- Proceeds from sales of goods and services

- Returns on investments

- Financial activities

- Interest earned over time

A company’s ability to create value for shareholders is determined by its ability to generate a positive cash flow — this is an indispensable metric for benchmarking the health of the business.

What is an outflow of cash?

Cash outflow refers to all the expenses paid out by your business. Cash outflow includes any debts, liabilities, and operating costs — any amount of funds leaving your business. Cash outflows include:

- Operating expenses

- Liabilities

- Debts (long-term debts, reinvestments)

- Annual interest rates

- Wholesale funding

What is a cash flow statement?

Statement of cash flows describes the different ways cash can enter and leave your business.

What is the main purpose of cash flow?

The purpose of the cash flow statement is to present a clear picture of the amount of cash flowing into the business and the amount of cash flowing out of the firm for a reporting period. These inflows and outflows are further classified into operating, investing, and financing activities.

Along with the information of cash inflow and outflow, investors use this information to discern the organization’s ability to generate cash and how the funds are used. The statement of cash flows is part of the financial statements, which includes the income statement and balance sheet.

This information helps in understanding if the core business of the firm is self-sustainable and has long-term growth prospects. It illuminates the management strategy and the future outlook of the firm.

How does the cash flow statement differ from the income statement and balance sheet?

Inc. writes: “The difference between the two is that the income statement also takes into account some non-cash accounting items such as depreciation. The cash flow statement strips away all of this and shows exactly how much actual money the company has generated…It provides a sharper picture of a company’s ability to pay creditors and finance growth.”

What is a cash flow forecast?

Cash flow forecasting is estimating the flow of cash in and out of a business over a specific period. Typically done by finance, cash flow forecasting requires input from multiple sources within the business.

Cash flow forecasting is essential to helping the business manage liquidity, ensuring the company has enough cash to meet its obligations and other business needs. By staying on top of its cash position, the company is better able to avoid cash shortages and earn returns on any cash surpluses they may have.

Forecasting cash inflows and outflows is especially important for new and/or fast-growing businesses. Poor cash flow management can lead to a plethora of problems for businesses, so it's best to ensure you have proper cash flow management in place.

What are the 3 types of cash flows by activities?

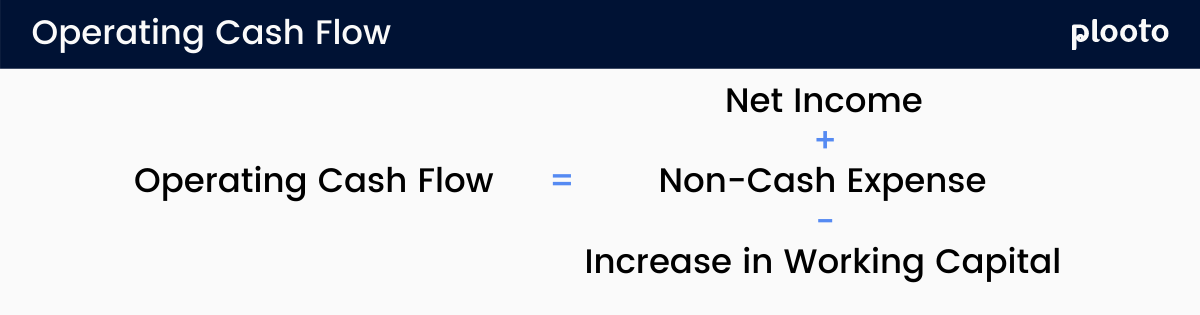

1. Cash flow from operating activities

Cash flow from operating activities is cash earned or spent in regular business activity—how your business typically makes money by selling products or services.

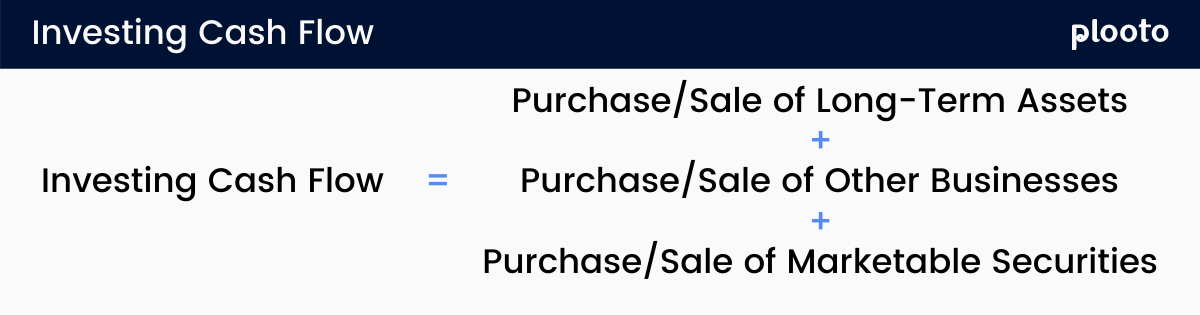

2. Cash flow from investing activities

Cash flow from investing activities is cash earned or spent from investments your company makes, such as purchasing equipment, real estate, or investing in other companies.

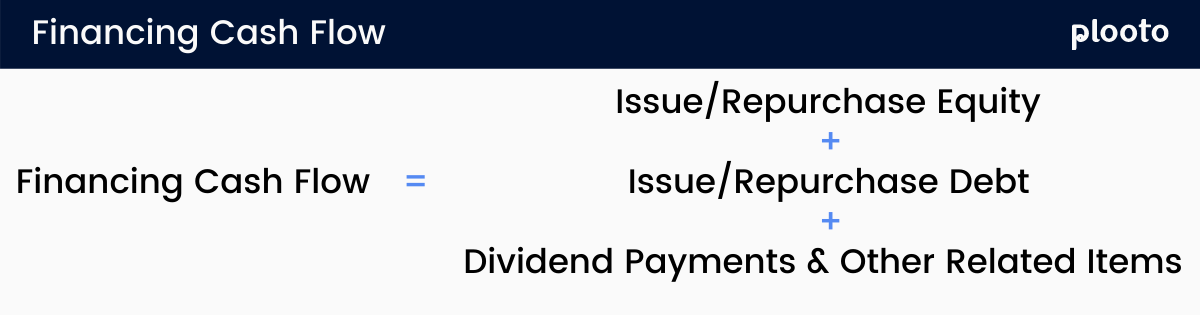

3. Cash flow from financing activities

Cash flow from financing activities is cash earned or spent in financing your company with loans, lines of credit, or owner’s equity.

What is cash flow analysis?

Cash Flow Analysis looks at a company’s cash inflows and outflows regarding its operations, financing, and investing activities. Cash flow analysis examines:

- How the company is generating its money

- Where the money is coming from

- What it means about the overall value of the company

Why is cash flow analysis important?

Cash flow analysis helps you to identify any problems with your incoming or outgoing cash flows. Cash flow analysis identifies under-performing revenue streams, signaling the need to make changes. If outgoing cash flow is trending higher than projected, cash flow analysis will help you identify the best ways to save money.

From this analysis, cash flow projections can then be created to improve your business's cash flow.

What is cash management?

Cash Management encompasses the daily activity of managing cash inflows and outflows. The ultimate goal of cash management is to maximize liquidity and minimize the cost of funds.

How do you calculate cash flow?

Now that you know what cash flow is and why it’s critical to the success of your business, you’re probably wondering: how do I calculate it? Check out the equation for calculating cash flow below:

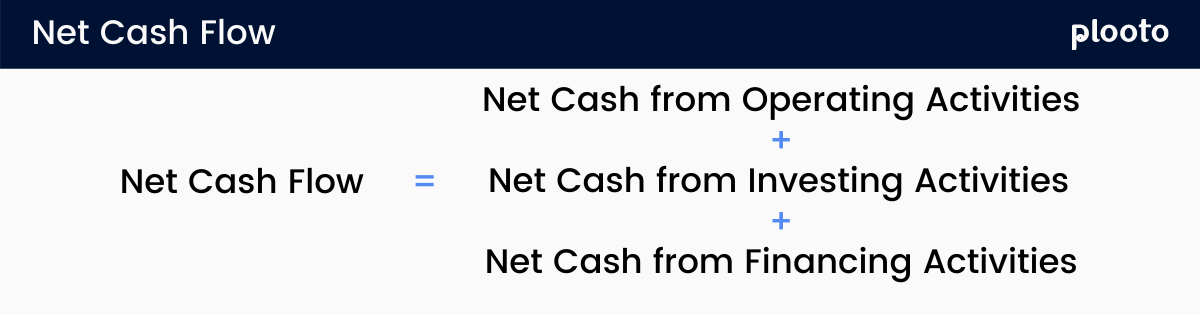

Net Cash Flow = Net Cash from Operating Activities + Net Cash from Investing Activities + Net Cash from Financing Activities

Very important: In order to complete this calculation to find out about the company’s financial health, you must understand the three different forms of cash flow: operating, investing, and financing.

Is cash flow the same as profit?

What could be the one question every new entrepreneur asks when starting their business...No. cash flow is not the same as profit. Yes, cash flow and profit are financial measures that are important to running a sustainable, successful business. But they are different. Here’s what you need to know:

Cash flow is how much money is going into and out of your business at a given time. It’s the money you have available to meet current and near-term obligations, including suppliers, employees, rent, insurance and other operational costs.

How is profit different from cash flow?

Profit is how much financial gain your company is making on the products or services it sells. If you are bringing in more money than it costs to run your business, you are making a profit. A business cannot survive unless it is profitable.

What you need to know: rapid or unexpected growth can cause a crisis of cash flow and or profit.

Building a foundation for success

Smarter financial management — one that is flexible enough to address both the immediate and long-term needs of the business — starts with planning and managing cash flow.

Plooto’s digital AP/AR solution with system-wide integration helps you stay ahead of your cash flow. You can time your payments to better manage your cash. You can track invoices and know when your clients pay. In addition, Plooto’s accounts receivable invoice automation gives you clear insight into your pending, completed, and new receivables — all from one place.

While there is no guarantee of success, proper financial management that includes cash flow planning will help prepare your company in advance for the inevitable downturns, missteps and mishaps that occur in business.

Worrying about managing your cash doesn’t need to keep you up at night. “How Do You Manage Cash Flow in Business?” offers actionable steps to help ensure you have enough cash on hand to meet near- and longer-term obligations, including 22 tips to improve your cash flow.

CHAPTERS

00 The Complete Guide to Cash Flow Management for your Business

01 How Do You Manage Cash Flow in Business?

02 How Much Cash Flow Should a Business Have?

03 Why Are Cash Flow Statements Important for Business?