Late and unpaid invoices can have a detrimental impact on your business if left unchecked. It affects your cash flow, reduces capacity for growth, and increases stress.

Staying on top of late and unpaid invoices is crucial to keeping your business afloat and re-investing your cash back into your business.

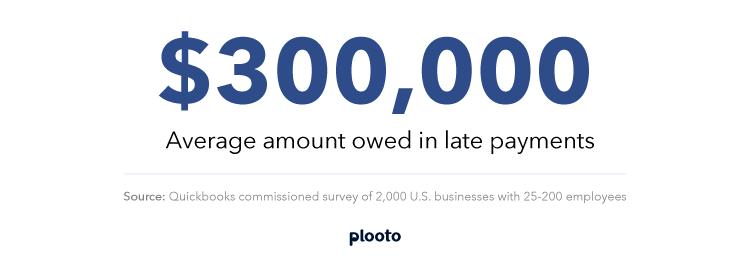

The True Cost of Late Payments

Did you know, according to a Quickbooks survey, approximately $300,000 is owed in late payments? Understanding the true cost of late payments is a step towards maximizing profits and ensuring positive cash flow.

Late payments can cause or exacerbate cash flow difficulties, hindering the ability of businesses to fund business activity. Chasing late payments also costs the business precious time; 65% of businesses stated they spend a daunting 14 hours per week on administrative tasks related to collecting payments. To put this in perspective, that’s almost two working days of labour costs spent towards non-growth-related administrative tasks.

Implications of late or unpaid invoices

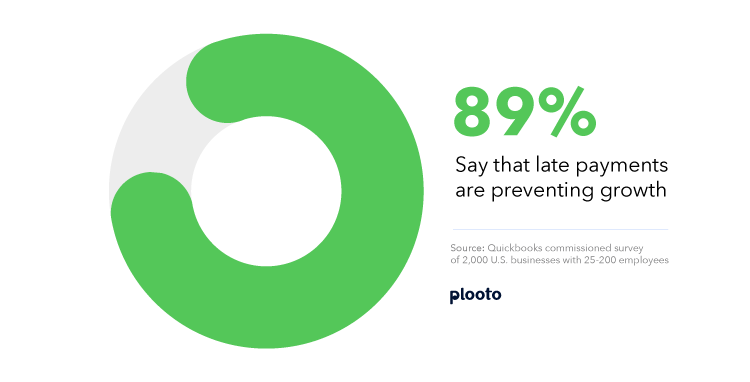

Reduced growth opportunities

Late/unpaid invoices deplete cash flow, limiting the ability to re-invest back into the business. When a business is lacking cash it is unable to hire new staff, purchase new inventory, or invest in development or marketing - drastically impacting where the business can expand. According to a Quickbooks survey, 89% of small-to-medium-sized businesses questioned said that late payments were preventing their growth.

This is especially pertinent for small-to-medium-sized businesses, which can't absorb the cost of late/unpaid payments and require cash for expansion.

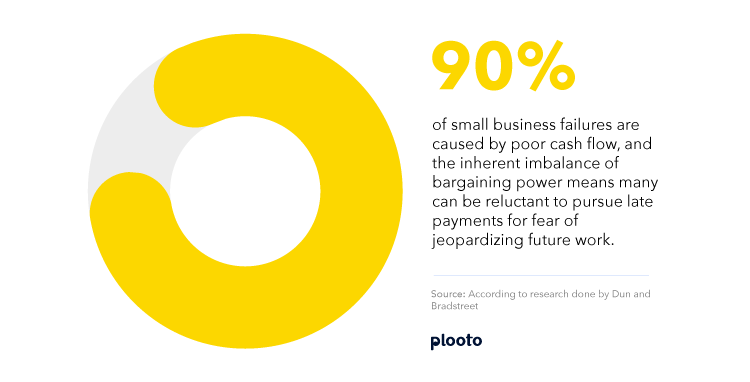

Crippling cash flow

Late/unpaid invoices can have a crippling impact on cash flow. Without consistent cash flow businesses are limited in their ability to pay suppliers or cover their daily business expenses. This can fatally damage the capability of businesses to function and succeed.

According to research done by Dun and Bradstreet, poor cash flow is the primary reason for around 90 percent of SMB failures and yet, only around 38 per cent of business invoices are paid on time. Late/unpaid invoices leave your cash flow vulnerable to sinking your business.

Increased stress and time waste

Late/unpaid invoices increase the stress of business owners leading to reduced productivity. Additionally, employee and owner time is wasted chasing after late/unpaid payments, a survey from Quickbooks found that 14 hours per week are wasted on administration work for late payments.

Best practices to streamline your internal financial admin processes

Send invoices as quickly as possible

The faster you send your invoices, the better the chance of receiving timely payment. This is especially important in times of cash instability when the timing of receiving cash is crucial. Additionally, by sending invoices quickly, you have a better chance of not missing their payment cycle.

Follow a regular payment schedule

Create a payment schedule with the agreed timing of payments. Payment schedules give both parties a timeline for when payments are made and allow you to better plan your cash flow. A set payment schedule helps hold customers accountable, minimizes confusion and reduces the chance of late/unpaid invoices.

Check your invoice system regularly

Check your system regularly to catch late/unpaid invoices so you can follow up with customers on a timely basis. This will help you forecast your cash in-flows and keep on track with notifying late payments.

How to make payment processing easy for customers

Be flexible with payment type

Remove obstacles to timely payment by offering several different payment options. Also, you can offer upfront payment options or a payment plan.

Automate invoices

Use a payment processing solution that automates manual tasks. This saves you time and makes it easier to track down late/unpaid invoices.

Write detailed invoices

Add the payment due date and payment terms directly on the invoice to communicate payment expectations. Also, add the invoice number on the top of the invoice to organize your invoices efficiently.

Use invoice management software

An invoice management software will make the payment process easier and more efficient. Use software to enhance visibility into your receivables and automate manual tasks. Invoice management software makes it easier for customers to send payments and gives them visibility into their payment due dates.

Offer different payment cycles

Consider offering customers more or less time from one bill to the next, for customers who purchase on a recurring basis.

Tips on how to dramatically reduce late and unpaid invoices

- Establish payment terms and dates upfront.

- Consider asking for deposits or partial payments before work is done.

- Send reminders to clients 5 to 10 days before the payment due date.

- Build relationships with customers to facilitate better communication about invoices.

- Use automation to save time and increase visibility.

- Offer early payment discounts to customers.

- Send reminders through email or phone to customers about late/unpaid invoices.

- Consider charging interest or late fees to incentivize customers to pay on time.

- Explore options for payment plans with clients.

- Stop providing goods/services until invoices are paid.

- As a last resort, file for legal action.

How Plooto can help with late and unpaid invoices

Plooto increases your cash visibility by displaying your receivables on a single platform. This allows you to manage your receivables in one place, instead of chasing and tracking down invoices. Additionally, Plooto gives you several payment options for your customers - credit, debit, and Plooto Instant are all accepted. This gives your customers the flexibility to pay how they want.

Plooto keeps you up-to-date with every step of an incoming payment. Knowing the timing helps you plan and prepare for cash inflows and keep track of payment timings - helping you better manage your cash flow.