Key takeaways

- Accounts receivable (AR) is a vital component of a company's finances, representing money owed by customers.

- AR is a current asset, contributing to a company's liquidity and financial health.

- Understanding the distinction between assets, liabilities, and equity is necessary for effective financial management.

- AR management can offer insights into sales trends, customer behavior, cash flow forecasting, and more

- Offering discounts on AR balances can impact a company's financial position and cash flow.

The definition of accounts receivable (AR)

Accounts receivable are the money owed to a company by its customers for goods delivered or services rendered by a seller.

Imagine you're a small business owner who recently completed a project for a client. You've sent out the invoice, but the payment hasn't arrived in your bank account yet, marking the transaction.

The outstanding amount is money customers owe you for completed work, waiting to be collected as accounts receivable.

What are assets?

In business accounting, assets are what a company owns that can make money in the future.

These assets are typically categorized into two categories:

-

Current assets, which are expected to be converted into cash or used up within one year

-

And long-term assets, which provide benefits over an extended period.

Accounts receivable, which falls under current assets, signify the money owed to the company by its customers for goods delivered or services rendered.

So, while it's not cash in hand quite yet, a company's accounts receivable are still considered valuable assets because they represent income to be paid on a future date.

What are liabilities?

Liabilities are the obligations a company owes to external parties like suppliers, lenders, or creditors.

This is in direct contrast to assets.

Unlike assets — resources owned by the company — liabilities represent what the company owes to others, indicating financial obligations that must be fulfilled.

Consider this scenario: a company takes out a loan to finance its operations. The loan amount is a liability because the company has to pay it back later. While assets hold value and can generate future income, liabilities are financial obligations that must be fulfilled. One means money coming in, the other money coming out.

Is accounts receivable an asset?

Absolutely. Accounts receivable is classified as a short-term current asset because it's expected to be converted into cash within one year — a relatively short period.

Regular monitoring of the receivable balance is essential for understanding the company's financial health and ensuring effective AR management.

Think about it this way: Every dollar sitting in your AR is money that you've already earned; it's just waiting to be collected.

From an accountant's point of view, this highlights how important accounts receivable are as a key asset that helps with the company's financial well-being, including its ability to collect on debts quickly — this improves AR turnover ratio.

In contrast, accounts payable is a liability.

Other examples of current assets are inventory, prepaid expenses, marketable securities, and short-term investments.

Further reading: Is AR a debit or credit?

Why is accounts receivable an asset?

Consider the impact of AR on a company's liquidity, working capital, and cash flow.

When your business consistently receives payments owed to it, this means you're getting regular income. This income can pay for your expenses, help your business grow, or keep operations running smoothly.

However, if you're not able to convert what customers owe you into cash, your business may face the risk of not being able to operate in the long run.

In accounting terms, accounts receivable is listed as an asset on a company's balance sheet. This shows its important role in maintaining the financial health of your business.

Is accounts receivable revenue?

No, accounts receivable is not income statement revenue.

Revenue is recognized when a sale is made or a service is provided — regardless of when the payment is received — as recorded in the income statement.

So, while AR represents money owed to you, it's not considered revenue until the payment is received.

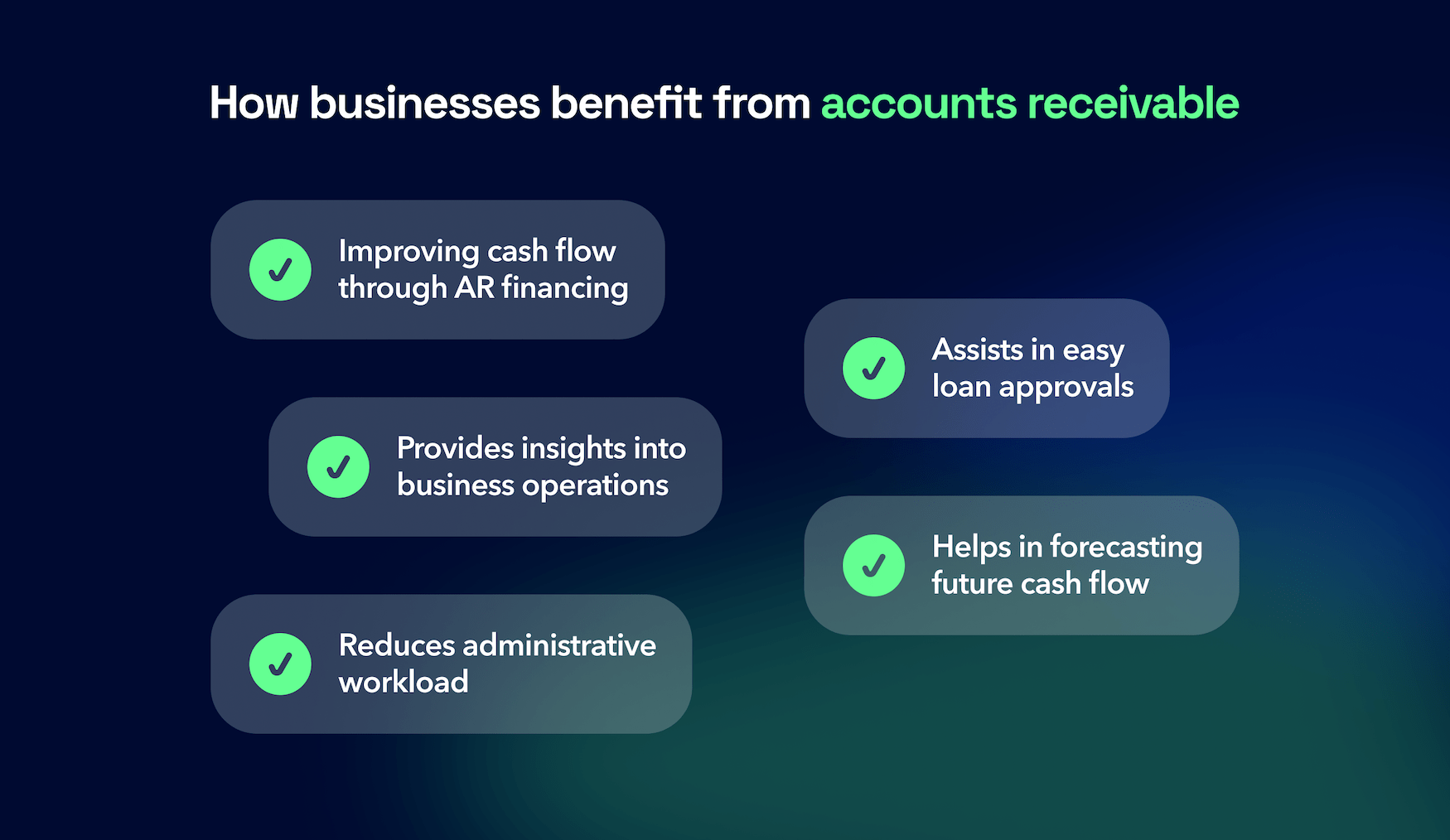

How businesses benefit from accounts receivable

Improving cash flow through AR financing

Imagine you need cash flow to cover your expenses but your accounts receivable are tied up in unpaid invoice balances. You'd feel trapped.

To solve this issue, companies can do what's called accounts receivable financing — also known as factoring. This offers businesses cash flow solution by selling unpaid invoices to a third party, often at a discount.

This strategy provides immediate cash instead of waiting for when a customer pays. This lets businesses cover expenses, invest in growth opportunities, or manage day-to-day operations more effectively.

Assists in easy loan approvals

Lenders often review a company's AR balance and its AR turnover ratio to gauge its creditworthiness when applying for loans or lines of credit.

A strong accounts receivable balance, coupled with a high AR turnover ratio, indicates consistent revenue and reliable customers. These factors improve your chances of loan approval.

The accounts receivable turnover ratio, which measures how quickly a company collects cash from receivables — as well as days sales outstanding (DSO) — is particularly important as it shows not just the volume of credit sales, but also how efficiently a company manages its collections.

Maintaining a healthy accounts receivable portfolio, with an emphasis on a good AR turnover ratio, can significantly improve a business’s chances of securing financing and obtaining additional capital for growth initiatives.

Provides insights into business operations

Analyzing your accounts receivable provides valuable insights into your business's sales trends, customer payment behavior, and overall financial health.

Are certain customers consistently delaying payments? Which product or service generates the majority of revenue? Your AR analysis can answer these questions, helping businesses make informed decisions.

Helps in forecasting future cash flow

Forecasting cash flow is essential for financial planning and budgeting. By analyzing accounts receivable aging reports and payment histories, businesses can predict future cash inflows and plan expenditures accordingly. This approach helps businesses predict potential cash shortages or surpluses, mitigate financial risks, and make informed decisions.

Reduces administrative workload

Let's face it: chasing down unpaid invoices can be a time-consuming and frustrating task. That's why many business are automating their accounts receivable processes.

By implementing accounts receivable automation software, you can streamline your invoicing process, reduce manual tasks, and free up time to focus on growing your business.

Accounts receivable are undeniably an asset for businesses, providing valuable insights, improving cash flow, and supporting growth opportunities. By knowing how it works and using it well, businesses can improve their finances and become more successful.

FAQs

How do companies handle uncollectible accounts?

Companies typically set aside a portion of their accounts receivable as an allowance for doubtful accounts to cover potential bad debts. This helps ensure their financial statements accurately reflect the true value of their AR.

What is the impact of late payments on accounts receivable?

Late payments can disrupt your cash flow and increase the risk of bad debts. That's why it's important to have clear payment terms in place and follow up promptly on overdue accounts to minimize the impact on your AR balance.

Is accounts receivable equity?

Accounts receivable, unlike equity, isn't a stake in the company’s accounts. Rather, it's a claim against your customers for payment owed to your business, reflected in the company's accounts. In essence, accounts receivable represent an asset, distinct from equity ownership.

AR has nothing to do with equity.

What are best practices for accounts receivable management?

Best practices include setting clear payment terms upfront, conducting credit checks on new customers, sending out invoices promptly, and following up when a customer is past due date. It's also important to regularly review your AR aging report to stay on top of collections.

Should you include a discount on your accounts receivable balance?

Offering early payment discounts to customers can incentivize prompt payments and improve your cash flow. However, it's essential to weigh the potential benefits against the impact on your bottom line and overall financial health before implementing discount policies.