The accounts receivable turnover ratio can be a helpful metric in determining the efficiency of your accounts receivable (AR) processes. The AR turnover ratio measures the number of times debts are collected from customers over a specified period.

Below, we cover how to calculate your AR turnover ratio and what it means for your company’s financial health.

Key takeaways

- The AR turnover ratio represents the number of times a company collects its AR over a period.

- The AR formula is found by dividing the average accounts receivable by net credit sales.

- Your AR turnover ratio can give important insight into the effectiveness of your AR collection process and if improvements need to be made.

- A higher AR turnover ratio is generally better. A higher ratio between seven and eight is ideal, but it is industry dependent.

- A low AR turnover ratio might indicate you need to make some changes to your AR process.

- There are multiple ways you can improve your accounts receivable turnover including: implementing automation, strengthening customer relationships, and offering discounts.

What is the accounts receivable turnover ratio, or AR turnover ratio?

The accounts receivable turnover ratio represents the number of times a company's accounts receivable has been collected in a specific time period. It's metric that shows how many times your AR is converted into cash.

The ratio gives insight into the company's effectiveness of converting their AR to cash.

Accounts receivable turnover ratio formula

To calculate accounts receivables turnover, use the AR turnover formula:

AR turnover ratio = Net credit sales / average accounts receivable

In this formula...

- Net credit sales = the amount of revenue earned by credit sales in a defined period of time

- Average accounts receivable balance = the average between the AR starting balance and ending accounts receivable balance in a specific period of time.

.png?width=1750&height=644&name=Accounts%20Receivable%20Turnover%20Ratio%20Formula%20(1).png)

AR turnover ratio calculation example

Let's put the accounts receivable turnover formula into practice.

Consider Company A's relevant finances during an accounting period:

|

Net credit sales |

$85,000 |

|

Starting accounts receivable balance |

$10,000 |

|

Ending accounts receivable balance |

$13,000 |

First, calculate the average accounts receivable:

($10,000 + $13,000)/2 = $11,500

Then plug that value into the formula:

AR turnover ratio= $85,000/$11,500 = 7.4

Company A's accounts receivables turnover ratio would be 7.4, which would be considered a high ratio, depending on the industry.

Understanding AR turnover ratios

AR turnover ratio measures your effectiveness at collecting debts. Your AR turnover ratio can give insight into your AR practices and what needs improvement.

A good accounts receivable turnover ratio is higher, but depends on the industry you're in.

Contrast this with accounts payable turnover, which measures how often you make your payments in a given period.

What can accounts receivable turnover ratio tell you?

A higher ratio shows you're doing a better job at converting credit sales into cash. Your receivables turnover ratio can give insight into your AR whether your practices are leading to a healthier cash flow.

What is a good accounts receivable turnover ratio?

In general, the higher your AR turnover ratio is the better. A high ratio would be around 7 to 8, but what is considered a high ratio is also dependent on the industry you are in.

If you find you have a lower ratio for the industry you're in, consider looking at your AR process to see where you can improve your accounts receivable turnover.

High vs. low accounts receivable turnover ratio

High AR turnover ratios

If you have a high accounts receivable turnover ratio, this could mean you have managed your cash flow well, and have maintained stronger creditworthiness. A higher ratio could show your company collects its AR more efficiently.

Having a high turnover ratio doesn't necessarily mean everything is good though — this efficiency might be the result of a very conservative credit policy. A conservative credit policy means the company is perhaps overly selective about whom it extends credit to, possibly requiring stricter terms or quicker payments from customers. This could cause a company to lose out on potential sales.

Low AR Turnover Ratios

If you have a lower accounts receivable turnover ratio, this could be a sign you are not managing your accounts receivable effectively. Perhaps your process isn't ideal, or your procedures for collecting from customers aren't efficient.

A low turnover ratio could also mean you are giving credit too easily, or your customer base is financially unreliable.

If you have a low ratio, consider ways you can improve your accounts receivable processes and efficiency. This could include implementing better policies for handling late payments, or adding automation to your AR process to speed up the steps needed.

The differences between AR turnover ratio and AP turnover ratio

AR turnover ratio and AP turnover ratio are both important but focus on difference aspects of financial health, just like how AR and AP themselves are different.

Key differences

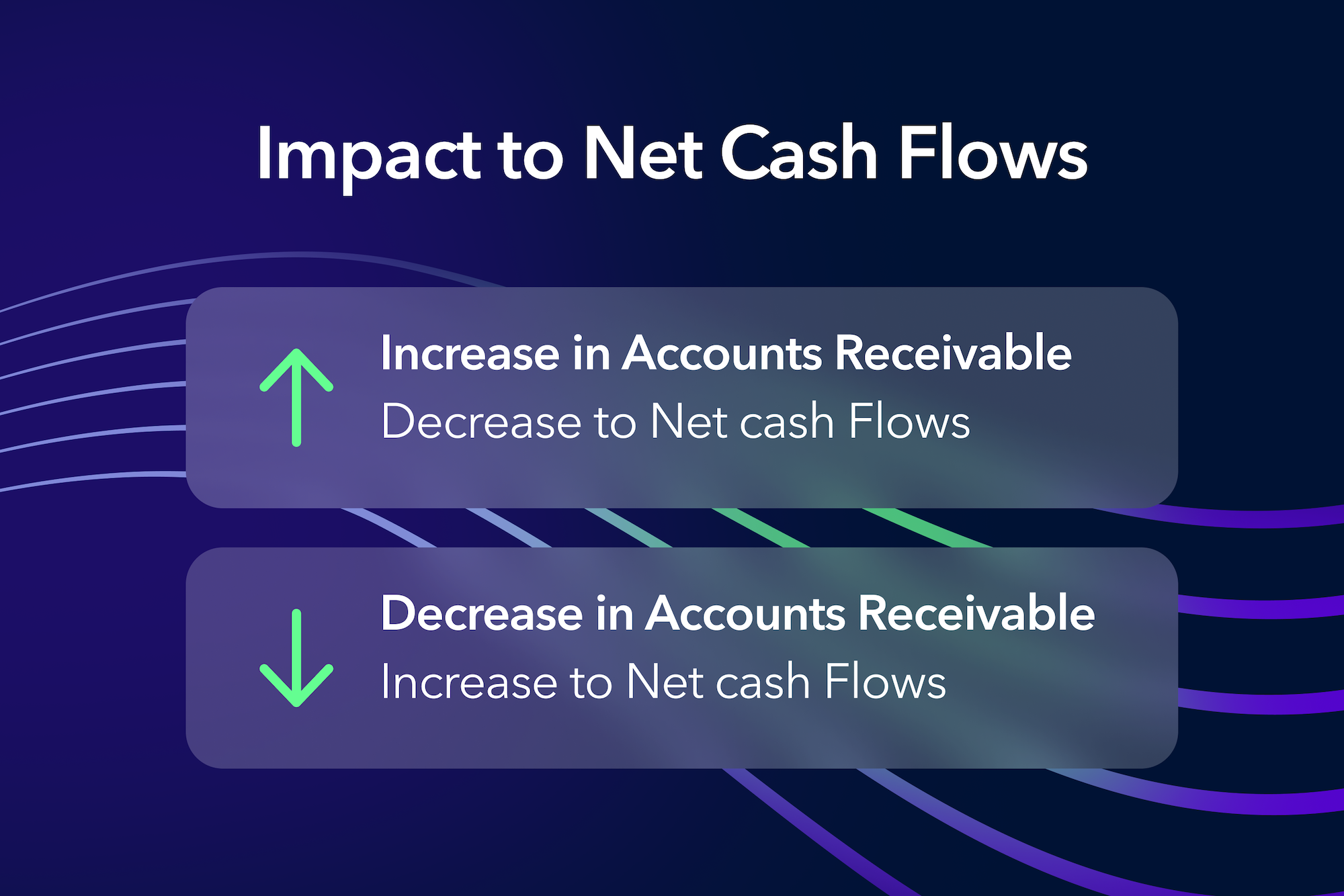

- Direction of cash flow: AR turnover involves cash coming into the business from customers, while AP turnover involves cash going out to suppliers.

- Objective: The AR ratio focuses on assessing the effectiveness of credit and collections policies, whereas the AP ratio evaluates the company's ability to meet its short-term liabilities and manage supplier relationships.

- Impact on cash flow: Efficient AR turnover improves cash flow by converting sales into cash quickly, while efficient AP turnover might conserve cash flow by optimizing the timing of payments to suppliers.

Just like optimizing your AR process is important, so is optimizing your AP process.

How to improve your AR turnover ratio

There are multiple ways you can improve your accounts receivable turnover. It's important to think about your AR process as a whole and identify weak points to be improved. Improving your AR turnover ratio will directly improve your cash flow.

.png?width=3000&height=2000&name=How%20to%20improve%20your%20AR%20Turnover%20Ratio%20(2).png)

Invoice regularly with accuracy

Sending invoices as soon as possible means faster payments. That being said, invoices must be accurate, as errors will slow down your collection process.

Ensure you have clear policies that maintain accuracy of the information on invoices, and procedures that send out invoices in a timely manner.

Automating your invoice management is a great way to do this.

Implement clear payment terms

Outlining clear payment terms for your customers will help to remove confusion for your customers on how, when, and how much to pay you. Ensure to follow up with your customers and still grant some flexibility if needed, like payment options or payment plans, for your customers.

Offer multiple payment options

Multiple payment options help make the payment process easier for customers. This helps drive customers to pay in a timely manner. Consider credit card, accepting online checks, and more.

Charge a late fee

Consider charging late fees for customers who pay late, this will incentivize customers to pay on time.

Send reminders to customers

Sending reminders to customers helps keep them on track of paying on time. A friendly reminder can help to improve relationships and get payments quicker. If you have outstanding receivables, reminders can also help to collect payments from customers who are overdue.

Consider offering discounts

Early payment discounts incentivizes faster payments from customers, and this ensures you get cash on time. This can help you to plan for your cash flow and gives you options with when you want to use that cash.

Build stronger relationships

Stronger relationships with your customers can help you get paid on time, as customers feel a sense of loyalty and responsibility to maintain a good relationship and pay promptly for your goods/services. A strong customer relationship can create a high-quality customer base, improve customer satisfaction, and incentivize repurchasing.

Incentivize cash sales

Skip the steps of the accounts receivable collection process by getting payments in cash. This way you save time from the AR process, and you get cash on hand immediately. To encourage cash payments, for example, you could offer a discount to customers who pay in cash.

Use automation

Implementing automation into your AR process can save you time and effort in collecting payments. With automation you can improve your accuracy and speed in sending invoices, and you can streamline and add visibility to your AR collection process.

Plooto's automation can help you manage your accounts receivable and improve your AR turnover ratio. Plooto offers automatic accounts reconciliation, setting up recurring payments, a variety of payment options, and visible tracking of invoices and payments.