In today's turbulent, disruptive times, businesses must stay financially agile. Effective liquidity management enables companies to make quick decisions, manage risk, and capitalize on business opportunities. In a recent survey with Forrester, more than 80% of the companies indicated that liquidity management is a priority.

“Liquidity Management Is Crucial to Succeeding in Today’s Hyper-Fast Environment” explores the strategies and tactics needed to implement an effective liquidity risk management program.

Sign up for a Free Trial today

Key Takeaways

- How accurate monitoring of liquidity helps companies find the right balance between having enough cash to meet financial obligations and taking advantage of growth opportunities

- 6 common liquidity management risks all businesses face

- Top 4 methods to assess liquidity and identify problems in advance

- What 12 factors contribute to liquidity risk

- 11 best practices for managing liquidity risk

SHORTCUTS

- What is liquidity?

- What is liquidity risk management?

- Common liquidity management risks

- What are sources of liquidity risk?

- 10 best practices in managing liquidity risk

- Why cash flow forecasting is an essential component of liquidity management

- How liquidity management solutions can help

What is liquidity?

Liquidity refers to the ease with which an asset or security can be converted into cash without affecting its market price. The more liquid an asset is, the easier and more efficient it is to convert it back into cash. Converting less liquid assets takes more time and costs more money. Cash is the most liquid asset.

Liquidity is a measure companies use to examine their ability to cover short-term financial obligations. It measures a business's ability to convert assets—or anything it owns with financial value—into cash. Healthy liquidity helps a company overcome financial challenges, secure loans, and plan for the future.

Liquidity management ensures the business has cash available when needed. This is achieved through proper planning and effective management of liquidity.

Why liquidity matters

Accurate liquidity visibility enables companies to make quick decisions, manage risk, and capitalize on business opportunities. Accurate monitoring of liquidity:

- Provides insights into your company's past, present, and future cash position

- Shows how your cash position will be affected by cash outflows or short-term liabilities

- Helps you find the right balance between having enough cash to meet financial obligations and taking advantage of substantial investment and growth opportunities

If you want to secure a loan or other funding, proper liquidity is crucial to your business. Liquidity ratios indicate your company's ability to pay off debt. It demonstrates to potential investors and creditors that your company is stable and has enough assets to weather hard times.

4 ratios to assess liquidity

Regularly assessing your company's liquidity helps you identify liquidity problems early. Liquidity ratios indicate a company's ability to meet upcoming debt payments with the most liquid part of its assets (cash on hand and short-term investments). It is the ratio between the company's current assets (liquid resources) and current liabilities (short-term debts).

An optimal liquidity ratio is between 1.5 and 2. Financial analysts often use liquidity ratios to assess a company's liquidity risk. These ratios compare a company's current assets to its current liabilities.

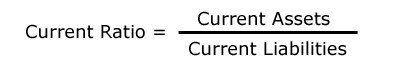

Current ratio

This ratio measures a company’s ability to pay its short-term obligations with its current assets. It is the simplest and most common way of calculating a company’s liquidity, which is dividing a company’s current assets by its current liabilities.

A high current ratio is generally considered a favorable sign for the company. Creditors are more willing to extend credit to those who can show that they have the resources to pay obligations.

Quick ratio

This ratio is similar to the current ratio, but it excludes inventory from the calculation of current assets because inventory can take time to convert into cash and may not be readily available to meet short-term obligations. The quick ratio is calculated by dividing a company’s current assets (cash + securities + accounts receivable) by its current liabilities.

Lenders look to the quick ratio because it shows the percentage of a firm’s debts that could be paid off by quickly converting assets into cash. Lenders often look at this ratio because the more liquid a firm’s assets, the better equipped it is to adapt to changing business conditions.

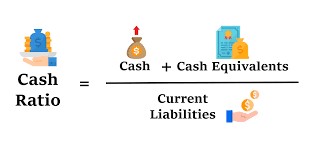

Cash ratio

This ratio measures a company’s ability to pay its short-term obligations with its most liquid assets: cash and cash equivalents. The cash ratio is calculated by dividing a company’s cash and cash equivalents by its current liabilities. If the company needed to pay all current liabilities immediately, cash ratio shows the company's ability to do so without having to sell or liquidate other assets.

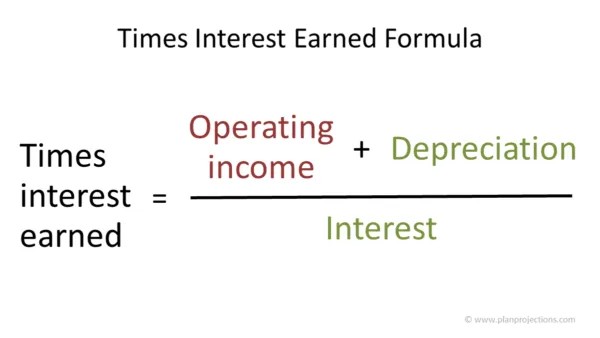

Times interest earned ratio = Earnings before tax and interest / Interest expense

The times interest earned (TIE) ratio is a measure of a company's ability to meet its debt obligations based on its current income. The formula for a company's TIE number is earnings before interest and taxes (EBIT) divided by the total interest payable on bonds and other debt. The result is a number that shows how many times a company could cover its interest charges with its pretax earnings.

What is an unhealthy liquidity ratio?

If the ratio is less than 1, the company does not have enough current assets on hand to pay for its current liabilities.

What happens if a company is too liquid?

A high liquidity ratio is not always a positive result. A high value — greater than 3 — may be a sign the company is overly focused on liquidity, at the expense of using capital effectively and business expansion.

What are the effects of poor liquidity in a business?

Poor liquidity means a business is at higher risk of failing if suddenly faced with unexpected debt. If the business is unable to convert enough assets to cash quickly to cover the debt ,it can push it into insolvency.

Can a profitable company have a liquidity problem?

A profitable company can still face a liquidity problem. Profitability and liquidity are two separate aspects of a company's financial health. Profitability measures a company's ability to generate profits from its operations. Liquidity refers to its ability to meet its short-term financial obligations, such as paying bills and expenses on time.

Although a company may be profitable in the long run, it could still experience short-term liquidity problems due to various factors, such as high levels of debt, slow-paying customers, unexpected expenses, or a sudden decrease in demand for its products or services.

In such cases, the company's profits may not provide enough cash on hand to cover immediate financial obligations, resulting in missed payments, late fees, and other negative impacts on the company's reputation and financial stability.

Therefore, it's crucial for companies to manage both their profitability and liquidity to ensure long-term financial success.

What is liquidity risk management?

Liquidity risk management ensures that the business can always fulfill its payment obligations and manage liquidity and funding risks within its risk tolerance. Liquidity risk management ensures the availability of cash or collateral to meet those needs at the appropriate time. This is done by coordinating the various sources of funds available to the business under normal and stressed situations.

Investors, managers, and creditors use liquidity measurement ratios to determine an organization's risk level. They often compare short-term liabilities and the liquid assets listed on a company's financial statements. If a business has too much liquidity risk, it must sell its assets, bring in additional revenue, or find another way to reduce the discrepancy between available cash and debt obligations.

Why liquidity risk management is important

Liquidity management indicates a company's financial health. It shows how well a company can afford its current and future debts, short-term investments, obligations, and spend with its liquid cash and assets on hand. If your business has enough cash or assets to convert into cash quickly, it's liquid. If the amount of cash and other assets does not exceed the amount of money you owe vendors and others, you have liquidity issues.

Liquidity risk management and cash flow management

Cash flow is the lifeblood of all organizations. Ensuring there is always enough cash (liquidity) available to meet financial obligations is critical. However, even the most well-managed businesses can run into cash flow problems due to unexpected costs or downturns in the economy. By proactively managing liquidity risk, companies can minimize the impact of cash inflows and outflows disruptions. This will ensure they have the funds to pay for day-to-day expenses. Liquidity management practices can include monitoring accounts receivable and accounts payable processes and increasing sales to generate more revenue.

Liquidity risk management and supply chain management

Supply chain management coordinates the flow of goods and resources from suppliers to customers. It is a complex process that involves managing multiple moving parts, including raw materials, inventory, finished products, transportation, and logistics. Supply chain disruptions can lead to increased costs, decreased sales, and lower profits. Therefore, companies need a liquidity management plan to manage disruptions.

5 key objectives of liquidity risk management

Liquidity management aims to minimize the risk of a shortage of liquid assets to pay creditors and prevent insolvency issues. The key objectives of liquidity management are:

- Minimize liquidity risk

One of the main objectives of liquidity management is to reduce the risk of a shortage of liquid assets to pay creditors. - Assess the company's financial health

Liquidity analyses provide insight into how well a company can pay its creditors in a timely and orderly manner. - Predict future cash positions

Accurate liquidity management should provide insights into how much cash is available now and in the future, contributing to more informed and strategic decision-making. - Increase business agility

Knowing what is financially feasible can help you capitalize on market trends faster to help grow your business. - Attract additional financing

Lowering your liquidity risk makes it easier to attract additional funding with favorable terms and conditions.

What are the major components of liquidity risk?

Liquidity risk is divided into short-term cash flow risk and long-term funding risk. Long-term funding risk includes the risk that loans may not be available when the business requires them or that such funds will not be available for the required term or at an acceptable cost.

Common liquidity management risks

There are several common liquidity risks that businesses can face:

Insolvency risk

If cash inflows are lower than forecasted, it can mean that you won't be able to pay your suppliers, lenders, or other required payments. Credit risk can result in selling illiquid assets at a lower price than their fair market value. Over the long term, this can result in insolvency.

Inability to attract additional financing

Having an over-leveraged business is detrimental when trying to secure financing. Even if you secure funding, the rates, terms, and conditions are likely to be unsatisfactory. This can severely limit a company’s options.

Poor visibility

A lack of visibility into your liquidity position can lead to unexpected expenses or disruptions in cash flow.

Lack of centralization

Decentralized systems can be highly inefficient and increase liquidity risk by potentially missing critical data while gathering it from multiple sources. This could lead to unwelcome financial surprises.

Operational risks

Discrepancies in cash inflows and outflows, resulting from human errors and fraud, can have a negative impact on your liquidity.

Market liquidity risk

This occurs when a company has more assets than debts, but cannot easily convert those assets into cash to pay off its debts. It is often referred to as asset Illiquid risk.

What are sources of liquidity risk?

Lack of cash flow management

Without proper management of cash flow, a business will increase its exposure to unnecessary liquidity risks.

Inability to obtain financing

The inability to obtain funding or to obtain it at competitive rates and acceptable terms increases liquidity risk.

Unexpected economic disruption reduced sales

Drastically low sales greatly increases liquidity risk.

Unplanned capital expenditures

An unforeseen capital expenditure, such as a new purchase or major equipment repairs, may exacerbate existing budget constraints and heighten liquidity risk.

Profit crisis

In a profit crisis, a business may have to deplete its cash reserves and face a liquidity crisis.

11 Best practices in managing liquidity risk

- Develop accurate cash flow forecasts

Accurate cash forecasts enable you to easily measure your cash positions at different points in time and see how well they perform against short-term liabilities that must be paid. - Examine counterparty insolvency risk

Before entering business with counterparties, examine their liquidity risk. - Establish policies and guidelines for decision-making

With guidelines and policies on cash allocation, you can avoid ill-timed, questionable expenditures. - Analyze external risks

Market risk, financial crises, and global events can have a major impact on your company’s liquidity. - Prevent operational risks

With the right systems, processes, and controls in place, operational risks can be tackled properly and liquidity risk decreases significantly. - Proactively manage accounts receivable

Take all the steps necessary to ensure your customers pay you on time. - Stay on top of your company financial health

Analyze your liquidity and cash in and out-flows regularly to mitigate any risks. - Manage liabilities

This includes paying off liabilities, reducing expenses, using long-term financing, and effectively managing receivables and payables. - Centralize all financial data

Finance and treasury teams can save time and resources, and prevent errors by centralizing all data into a centralized liquidity management system. - Automate reporting

Automated reporting for liquidity management decreases the risk of human-made errors and it frees up staff time to focus on more strategic, value-adding activities. - Consider seasonal adjustments

This can mean that your cash inflows and outflows vary depending on each season, which must be accounted for to make sure you can continue paying your creditors.

CHAPTERS

00 Why Effective Working Capital Management Can Improve Your Entire Business

01 How to Ignite Your Company’s Growth With Working Capital

02 Proven Strategies for Optimizing Your Cash Management

03 Unlock the Power of Spend Management: A Guide for Small and Mid-Size Businesses

04 Liquidity Management Is Crucial to Succeeding in Today’s Hyper-Fast Environment

05 Cash management strategies for small business survival

Why cash flow forecasting is an essential component of liquidity management

Cash flow forecasting is a powerful tool for liquidity management. It involves projecting future cash inflows and outflows to estimate the expected cash balance at a future date. Cash flow forecasting can help companies make better decisions regarding their cash position and avoid potential cash shortages.

Here’s how cash flow forecasting supports liquidity management:

Identifying potential cash shortages

By forecasting cash inflows and outflows, an organization can identify potential cash shortages and take proactive measures to address them. This can include increasing revenue, reducing expenses, or arranging additional financing.

Managing working capital

Cash flow forecasting can help organizations manage working capital more effectively by identifying trends in cash inflows and outflows. This can help them optimize their inventory, accounts receivable, and accounts payable to ensure they have sufficient cash to meet their obligations.

Improving cash visibility

Cash flow forecasting provides greater visibility into an organization's cash position, enabling better cash management decisions. This may entail optimizing investment strategies, reducing idle cash balances, and prioritizing cash disbursements.

Supporting long-term planning

Cash flow forecasting can also help organizations with long-term planning by providing insights into future cash requirements and helping them plan for capital investments, debt repayments, and other significant cash outlays.

What is the difference between cash management and liquidity management?

Cash management entails account payment and receivables functions. Effective liquidity management ensures that a company has enough liquidity from receivables, cash or borrowing capacity to pay bills.

12 factors that impact liquidity risk

- Inventory

- Uncollected receivables

- Outstanding payables

- Reduced credit limits

- Seasonal fluctuations in revenue generation

- Business disruptions

- Unplanned capital expenditures

- Increased operational costs

- Poor working capital management

- Poor matching of asset duration to debt duration

- Limited financing facilities

- Poor cash flow management

How liquidity management solutions can help

In today's rapidly changing business landscape, finance teams must make quick decisions based on reliable liquidity analyses. Immediate insight into liquidity positions and forecasts can speed decision-making and increase business agility. In addition, proper tools enable the finance team to report on company liquidity on an ad-hoc basis to internal and external stakeholders — including company leaders, auditors, and investors.

Liquidity management software, Plooto, and accounting software can work together to provide a more comprehensive view of a company's financial position. Liquidity management software solutions consolidate cash flow data from many systems and streamline liquidity management processes and reporting. Plooto simplifies and automates cash flow management through a single integrated AP/AR platform, providing complete visibility into the entire cash flow cycle.

Plooto's dashboard enables you to identify and review your:

- Pending payables

- Payments in progress

- Completed payables and receivables

In addition, Plooto handles multiple payment types, including check payments, ACH, and EFT payments. Plooto Instant is among the fastest methods to pay vendors.

Seamless data integration between Plooto and your accounting software ensures accurate recording of information, correct payments, and a more manageable, faster end-of-month reconciliation. Seamless filtering options enable you to categorize vendor payments by amount, bank account, and recurring payment status.

You can filter the raw data and use it for various reporting purposes, such as reviewing specific suppliers. For deeper analysis and reporting, you can easily export this data into an Excel/ csv file, which you can import into third-party data tools for study.

Select spend management software can feed transactional data into accounting/financial software for generating financial reports and analysis.

Analyzing data collected from liquidity management software, Plooto, and accounting software makes it easier to assess liquidity and drive faster and more decision-making. Companies have a more comprehensive and accurate view of their financial position to address liquidity risk. In addition, using liquidity management software, Plooto, and accounting software helps reduce errors, increase efficiency, save time, and cut costs by automating manual processes.

Innovation, change, and decision-making are all happening faster today. Effective liquidity management helps businesses keep up and stay solvent. It addresses the big question all companies face: how to minimize risk while being agile enough to handle short-term debts and capitalize on immediate investment and growth opportunities.

FREQUENTLY ASKED QUESTIONS

What Is Liquidity Management?

Liquidity risk management ensures that the business can always fulfill its payment obligations and manage liquidity and funding risks within its risk tolerance. Liquidity risk management ensures the availability of cash or collateral to meet those needs at the appropriate time.

What are the most liquid assets or securities?

Cash in hand; cash in the bank; cash equivalents.

Why Is Liquidity Risk Management Important?

Liquidity management indicates a company's financial health. It shows how well a company can afford its current and future debts, short-term investments, obligations, and spend with its liquid cash and assets on hand.