The accounts payable (AP) turnover ratio gives you valuable insight into the financial condition of your company. It is used to assess the effectiveness of your AP process and can alert you to changes needed in your financial management.

Below we cover how to calculate and use the AP turnover ratio to better your company's finances.

Key takeaways

- The accounts payable turnover ratio indicates how quickly accounts payable are paid off in a period.

- You can manually calculate accounts payable turnover, or use technology to calculate it for you.

- The accounts payable turnover ratio can give you insight into how efficient your cash flow and accounts payable management is.

- A typical turnover ratio depends on the industry, but likely falls between 6 and 10.

- The AP turnover ratio quantifies the rate that money is paid off, while accounts receivable turnover ratio measures how quickly you receive money from customers.

What is the accounts payable turnover ratio, or AP turnover ratio?

Accounts payable turnover ratio, or AP turnover ratio, is a measure of how many times a company pays off AP during a period. It gives insight into the short-term liquidity of a company.

Simply, the AP turnover ratio gives a measure of the rate suppliers/vendors are paid off.

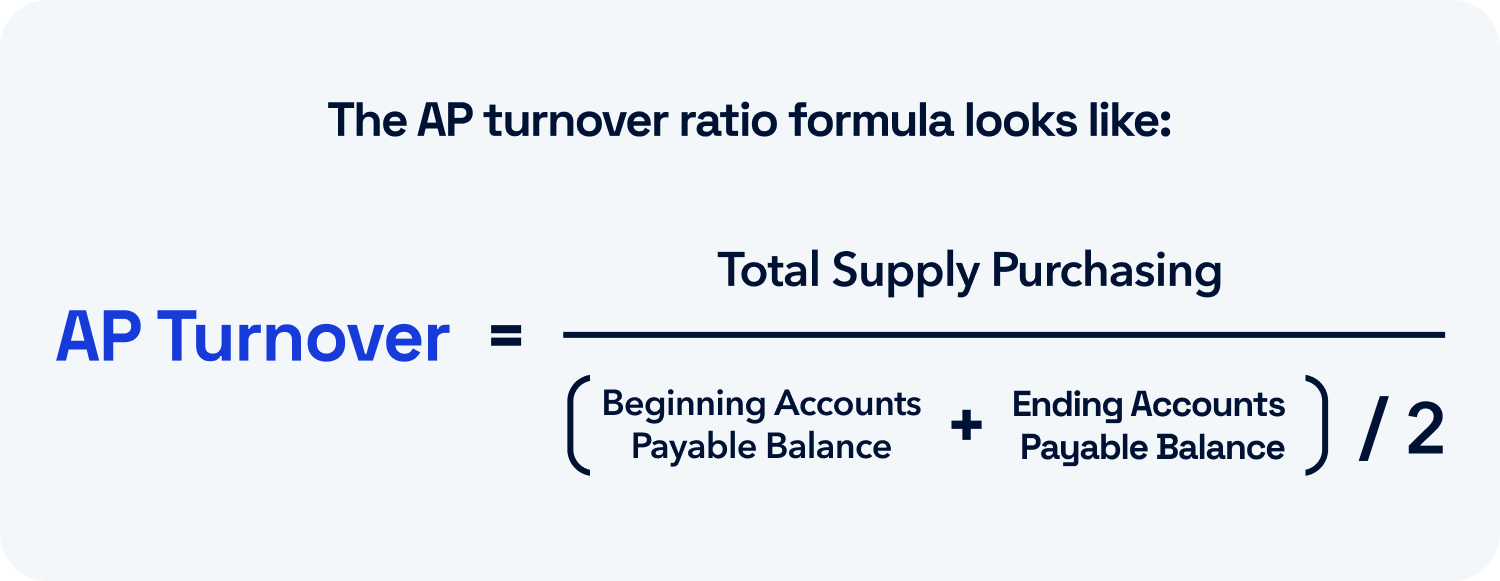

Accounts payable turnover ratio formula

To calculate accounts payable turnover, take net credit purchases and divide it by the average accounts payable balance. The AP turnover ratio formula is...

AP turnover = TSP/(BAP + EAP)/2

Where:

AP = accounts payable

TSP = Total supply purchases, or net credit purchases

BAP = Beginning accounts payable balance

EAP = Ending accounts payable balance

Calculating net credit purchases

Net credit purchases = Total purchases - cash purchases - purchases returns

AP turnover ratio calculation example

Let's put the formula into practice.

For this example, we will look at the ratio over a year. Here is the table of Company A's relevant finances:

| Reported purchases on credit | $25,000 |

| Accounts payable at beginning of year | $7,000 |

| Accounts payable at end of year | $500 |

So, AP turnover = $25,000 / (( $5,000 + $500 ) / 2 ) = 6.67

This figure means that Company A fully paid off their accounts payable six times over a year.

What the AP turnover ratio can tell you

The AP turnover ratio shows how many times in a period a company pays off its accounts payable.

You can use the figure as a financial analysis to determine if a company has enough cash or revenue to meet its short-term obligations.

Why is the accounts payable turnover ratio important?

Accounts payable turnover ratio is important because it measures your liquidity and can show the creditworthiness of the company.

The ratio you calculate can give insight into the efficiency of your accounts payable process. A high turnover ratio could mean fast payments to suppliers, or that you're taking advantage of early payment discounts. Both are good things!

A lower accounts payable turnover ratio means slower payments, or might signal a cash flow problem — which would be bad, of course.

Alternatively, a lower ratio could also show you've been able to negotiate favourable payment terms — a positive situation for your company.

High vs. low: What is considered a normal turnover ratio?

When assessing your turnover ratio, keep in mind that a "normal" turnover ratio varies by industry.

Usually, an accounts payable turnover ratio between 6 and 10 is ideal.

Below 6 indicates a low AP turnover ratio, and might show you're not generating enough revenue.

High AP turnover ratios

A high turnover ratio could mean your company:

-

Pays off suppliers at a faster rate

-

Has cash available

-

Manages cash flow effectively

-

Perhaps is not reinvesting back in the business

Low AP Turnover Ratios

A low turnover ratio could mean your company:

-

Takes longer to pay off debt

-

Isn't managing cash flow effectively

-

Negotiates favourable payment terms

-

Is using cash to reinvest in the business

%20Turnover%20Ratio.png?width=1052&height=743&name=4%20Tips%20to%20Improve%20Your%20Accounts%20Payable%20(AP)%20Turnover%20Ratio.png)

This shows that having a high or low AP turnover ratio doesn't always mean your turnover ratio is good or bad. It is just a signal of your current situation. Teams then need to dig in and understand why their ratio is what it is.

How to improve your AP turnover ratio

To improve your accounts payable turnover ratio, consider trying to:

-

Negotiate better payment terms

-

Improve your cash flow management

-

Optimize your accounts receivable

The importance of a high AP turnover ratio

Having a high AP turnover ratio is important in determining the effectiveness of your accounts payable management. It can show cash is being used efficiently, favourable payment terms, and a sign of creditworthiness.

A high accounts payable turnover ratio is an important measure in evaluating your financial position, and gives insight to where you can improve.

4 Tips to improve your accounts payable (AP) turnover ratio

1. Increase your cash flow

One way to improve your AP turnover ratio is to increase the inflow of cash into your business. More cash allows you to pay off bills, and the faster you receive cash, the fast you can make payments.

To improve cash flow consider how you can speed up your accounts receivable process, and incentivize customers to pay faster.

2. Pay your bills early

Paying your bills early and consistently, can greatly improve your accounts payable turnover ratio. Consider the impact of paying bills early: you could benefit from early payment discounts, but be mindful of how it might impact your cash flow.

3. Renegotiate payment terms

By renegotiating payment terms with your vendors, you can improve the length of time you have to pay, and can improve relationships by paying on time.

4. Switch to an automated AP solution

Your payables turnover ratio can be improved by implementing an automated AP software.

Automation can speed up your AP process, as well as keep you up-to-date on payments, due dates, and a centralized place for all your bills.

The difference between the AP turnover and AR turnover ratios

Accounts receivable turnover ratio is another accounting measure used to assess financial health. Accounts receivable (AR) turnover ratio simply measures the effectiveness in collecting money from customers.

The accounts payable turnover ratio quantifies the rate that money is paid off. Simply, it measures how quickly a company pays off their accounts payable.

Learn more about the differences between accounts receivable and accounts payable.