The complete guide to working capital

Understanding its key strategies, formulas, and use cases is crucial for assessing your company's financial health.

Key takeaways

- Working capital is the money a business uses to pay its short-term obligations.

- Subtract the company's current liabilities from its current assets to calculate WC.

- Working capital is important because it shows how easily a company can pay its bills and manage its money.

- Divide the company's current assets by its current liabilities to calculate working capital ratio. The ideal ratio varies by industry, but the conventional wisdom is between 1.5 and 2.

- Working capital can be improved by cutting unnecessary expenses, optimizing your accounts receivable process, negotiating better terms with suppliers, and monitoring the working capital ratio.

What is working capital?

Working capital is the money a company uses to meet its short-term operational needs and obligations. It's also one way to measure a company's health: If a company can't meet its short-term needs, its prognosis for the long term might not be good.

It’s also referred to as net current assets, operational capital, or current capital.

How to calculate working capital

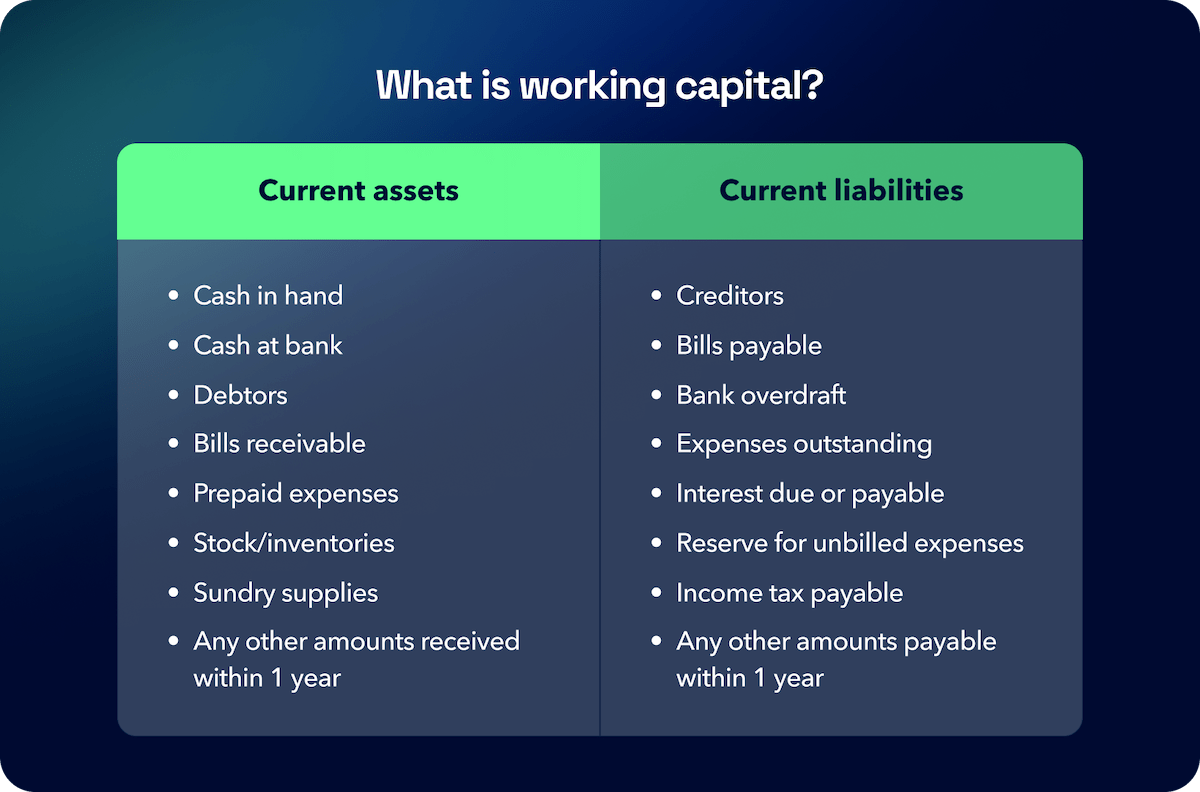

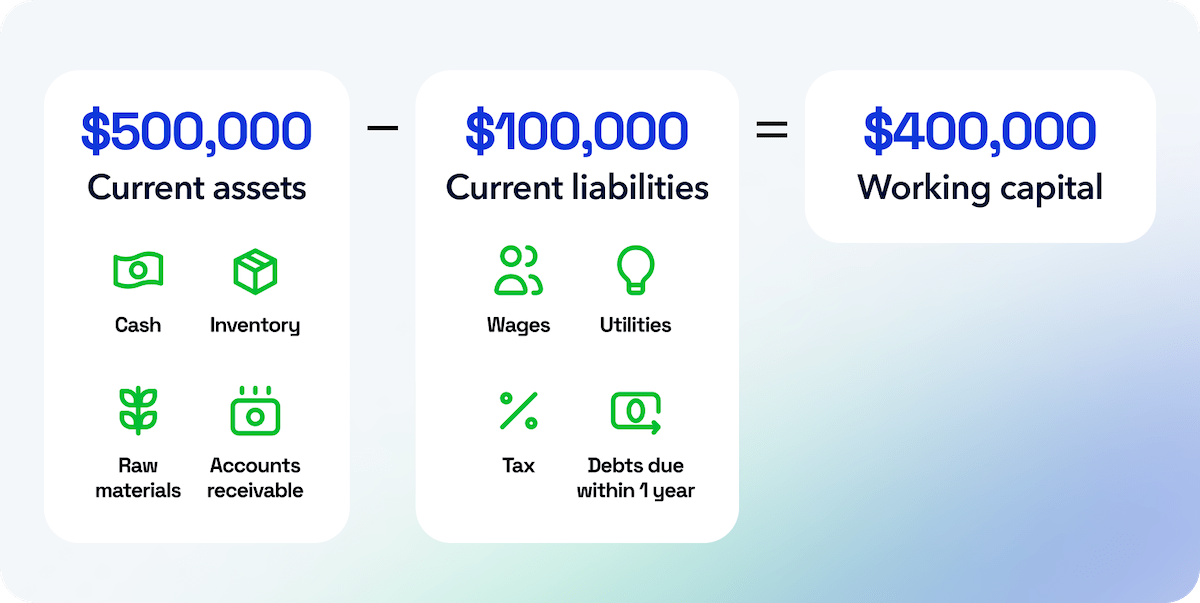

A company's working capital can be calculated by finding the difference between a company's current assets and liabilities on its balance sheet. Current assets include things like cash, accounts receivable, inventory, and marketable securities that the company possesses — the key is that they are or can be converted into usable funds within one year.

Current liabilities, on the other hand, are bills that the business must pay within a maximum of one year, including accounts payable, accrued expenses, rent, etc.

For example, let's say a train company, GoTrainGo, has $500,000 in current assets and $100,000 in current liabilities. Its net current would be (500,000 - 100,000), or $400,000. That's their WC.

So, the formula is simple:

Working capital = Current assets - current liabilities

Why working capital is important

Working capital (WC) is key to keeping a business running. In particular, it's vital for keeping money moving in and out of the business smoothly.

A larger financial buffer lets a company manage excessive debt better, fulfill financial duties, and maintain a stable environment. All of these keep employees and investors happy.

Additionally, as this liquidity buffer grows, it suggests the company could be ready to expand.

When these funds are low or negative—where liabilities exceed assets—it may suggest that the company is struggling to meet its short-term obligations and could be at greater risk of setbacks without extra financing.

It's also possible to have too much working capital. Very high levels can mean the company isn't investing wisely and is letting too much money sit idle.

It's important to remember that the ideal amount of liquidity varies by business type and industry. What works for one company may not work for another, and low or even negative operational capital doesn't always mean a company is in trouble.

High vs low vs optimal working capital — an example

Let’s take a look at the hypothetical train-manufacturing company, GoTrainGo.

Scenario: Optimal liquidity

GoTrainGo has $500,000 in current assets and $300,000 in current liabilities, giving them a working, or operational, capital of $200,000. These resources let them meet financial obligations like making B2B payments and paying employees promptly, and to handle unexpected expenses efficiently.

Scenario: Low liquidity

Due to a market downturn, GoTrainGo’s current assets drop to $350,000 while liabilities remain at $300,000, reducing their operational capital to $50,000. This lower level could lead to difficulties in meeting supplier payments and missed opportunities for cost-saving purchases, possibly requiring a short-term loan for future needs.

Scenario: Excessively high liquidity

With a sales surge, GoTrainGo’s assets rise to $1 million against $300,000 liabilities, resulting in $700,000 in WC. With this additional working capital, this may indicate missed opportunities to expand the business, potentially limiting higher revenue generation.

The importance of working capital efficiency

Working capital efficiency is one measurement of how well a company manages its liquidity — in other words, the efficiency of its cash flow.

Investors often use this figure to help them determine whether to invest in a company. Some questions they might consider:

- What is the company's ratio of current assets to liabilities?

- If the company sells physical products, how frequently does it restock its inventory? If it restocks often, is this due to strong sales or because it has problems with efficient restocking?

- How long does the company generally take to collect its accounts receivable?

In its 2021-2022 study on working capital, PricewaterhouseCoopers found that 65% of executives surveyed "named working capital efficiency as the main objective for change management and restructuring activities."

Understanding working capital

Let's dive into WC as a concept — including its components, advantages and limitations, and relationships to other types of capital.

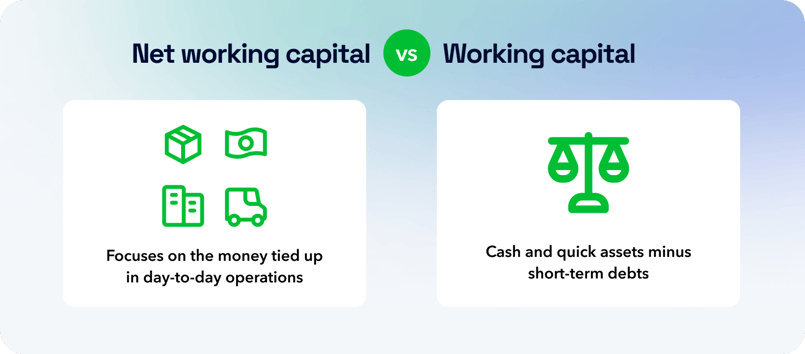

Working capital vs. net working capital

Working capital and net working capital are closely related and vital for assessing a company's financial health, but they focus on slightly different financial details.

Put simply:

- Working capital is the cash and quick assets minus short-term debts.

- Net working capital focuses more on the money tied up in the day-to-day operations of the business, excluding cash and debt. It tells us how much of the company’s everyday working assets are paid for by everyday debts.

In more depth:

Working capital refers to the difference between a company's current assets and its current liabilities. In other words, it measures a company's liquidity and its ability to cover short-term bills without needing outside funding.

- Current assets include cash, accounts receivable, inventory, and other assets that are expected to be liquidated or turned into cash within a year.

- Current liabilities are obligations the company expects to pay within the same timeframe, like accounts payable, wages, income taxes payable, rent, short-term loans, and the current portion of long-term debts.

Net working capital considers only the operational parts of assets and liabilities, excluding cash and debt.

Working capital formula: Working capital = Current assets − current liabilities

Net working capital formula: Net working capital = (Current assets − cash and equivalents) − (current liabilities − interest-bearing liabilities)

Working capital vs. fixed assets

Fixed assets, also known as fixed capital, are acquired and used to run a business long-term. Based on your industry, example of fixed assets can include:

- Land

- Buildings

- Offices

- Trucks

- Delivery vehicles

- Office furniture

- Factory equipment

- Long-term software

- Livestock like sheep, horses, or cattle

WC, though crucial, is less 'fundamental' than long-term assets.

Think of a business like a house. The fundamental components of the house — the frame, the floors, the walls, the appliances, the lights — are essential to its function as a home. In this metaphor, these are like fixed assets.

-min.png?width=805&height=633&name=Different%20types%20of%20fixed%20assets%20(1)-min.png)

Day to day, though, smaller tools help the house succeed in its short-term operations. Dishes, pillows, bedsheets — you'll cycle through them faster than you cycle through walls and floors (hopefully, at least), but they still do important work to make your house a home.

Components of working capital

Next, let's look at the two primary components of working capital: current assets and current liabilities. As we learned above, WC is calculated by subtracting the amount of a company's current liabilities from the amount of its current assets.

Current assets

Current assets (or liquid assets) are assets that a company can reasonably expect to use within a year as part of its normal operating expenses. As such, they should be easily convertible to cash. Current assets might include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Equity

Current liabilities

Current liabilities are debts the company is on the hook to pay within a year. Some examples of current liabilities are:

- Accounts payable

- Short-term debts, including interest owed

- Salary for employees, including payroll taxes

- Utilities

Advantages of working capital

Having sufficient operating liquidity comes with plenty of advantages. First and foremost, it ensures that a company has enough cash to pay its bills on time and remain solvent today. It also might mean the company can offer flexible financing options to its customers. Finally, lots of liquidity may be an indicator that the company is ready to invest in long-term growth tomorrow.

Highly seasonal businesses can also benefit from high levels of working capital as their busy season approaches since they'll likely have higher operational costs and may need a higher volume of product during peak times.

Limitations of working capital

It's important to note that there are limitations to working capital as a metric of business health. For instance: As opposed to net working capital, it is a short-term metric, so it doesn't necessarily take into account the company's long-term health.

External headwinds beyond the company's control can also affect its usefulness.

For example, a sudden supply chain problem could severely affect inventory. Even the best liquidity management strategy can’t anticipate every major external event.

How working capital affects cash flow

When working capital increases, cash flow generally decreases because the business ties it up in day-to-day operations, making it unavailable for other purposes.

For example: Let's consider another GoTrainGo again, the imaginary train manufacturing company.

Imagine they designed a new type of high-speed train car expected to be very popular, with several new contracts pending.

They might decide to buy extra raw materials like steel, computer chips, seat cushions, or the machinery needed to build the train cars.

This will increase their current assets but decrease their cash flow because they used the cash to make the purchases.

What is negative working capital?

If liabilities exceed assets, a company has negative working capital, indicating it owes more than it owns in the short term.

This situation can hinder the company's ability to fund new short-term investments, although this is not always the case.

Inversely, positive working capital is when a company’s current assets instead exceed its liabilities.

Is negative working capital bad?

To put it simply: It depends. Negative working capital isn't necessarily a sign of poor financial health.

In many cases, though, negative operational capital is indeed not a good thing: It could mean that a company is unable to meet its short-term financial obligations.

It can also signal instability to potential investors.

For some companies with fast-moving inventory and high brand value, though, brief forays into negative working capital can have advantages. Some examples of these companies include:

- Large grocery and discount stores

- Fast food restaurants

- Utilities, like gas and electric companies

Sam Walton, the founder of Walmart, famously favored periods of negative working capital for his businesses.

After buying large amounts of inventory, he sold that inventory so quickly in-store that he profited from his original investment before having to pay his suppliers.

The outcome? Large swaths of cash could be put towards growing his business, despite the business technically debt on the “wrong” side of the ledger.

The working capital ratio

The "working capital ratio" is another way of measuring business liquidity, or the amount of liquid assets available to a company. It’s a financial metric calculated by dividing the business's current assets by its current liabilities. Note that this is different from the calculation for working capital.

For example, if GoTrainGo has current assets worth $300,000 and $260,000 in liabilities, its working capital ratio is (300,000 / 260,000), or 1.15.

The working capital ratio formula is:

Working capital ratio = Current assets / current liabilities

What is a good working capital ratio?

Good working capital ratios depend on many things like industry, seasonality, and capital management strategy. However, the rule of thumb is that a healthy ratio is between 1.5 and 2.

As with the working capital figure itself, the working capital ratio shouldn't be too low or too high. Too low and the company may struggle to pay its bills — but a higher ratio than 2 may indicate that funds are not being used efficiently.

If a company's working capital ratio falls below one, its current assets total less than its current liabilities. In other words, its working capital is negative.

Types of working capital

There are quite a few types of operational capital, each providing unique information about the business.

Permanent

Permanent WC refers to the baseline amount of working capital a company always needs to keep operating. The term is used interchangeably with "fixed working capital" or "fixed assets."

Temporary

Temporary working capital is an important term for seasonal businesses. It's the extra working capital a business might need to operate during relatively anomalous periods — whether that's the lead-up to an annual busy season or a rare special event.

Net and gross

As mentioned above, net working capital (WC) calculates the total of a company's long-term and short-term assets minus its long-term and short-term liabilities.

On the other hand, gross working capital measures the total value of a company's assets before subtracting any liabilities. Therefore, this number is usually higher but may not provide the most accurate reflection of the company’s financial health.

Negative

If a company has negative WC, the amount of its short-term liabilities exceeds the amount of its short-term assets.

Reserve

Reserve WC is essentially the "break glass in case of emergency" of capital — the company keeps it available to help it weather unexpected difficulties or seasonal changes. It falls under the umbrella of permanent working capital.

Regular

Regular WC is also a type of permanent capital. It's used for regular, day-to-day operations.

Seasonal

Many businesses are seasonal, which means the level of demand for their services varies heavily throughout the year. Seasonal WC refers to the amount of capital a business needs to operate during its busiest season. For example, a company that sells artificial Christmas trees might experience a busy season leading up to Christmas, and will thus need additional capital to operate properly.

Special

Special WC is similar to seasonal capital but refers to a one-off event rather than a peak season. For a company that makes protective eclipse glasses, for instance, that event might be a total solar eclipse, for which there are decades between occurrences.

Does working capital change?

Yes, it is a highly variable metric. Here are a few examples of the ways it can fluctuate:

Daily changes

For one thing, operational capital can fluctuate just from day-to-day operations. Businesses have lots of moving parts, and assets and liabilities can change with every transaction and payment.

Current assets may be written off

If an asset no longer makes money, it will likely be written off. For example, if a machine is beyond repair and can't be sold for parts, it will be removed from the business’s assets.

Assets can be devalued

Assets can decrease in value because of external events. For example, inventory might be stolen, damaged in a natural disaster, or become obsolete.

Accounts receivable may be written off

Accounts receivable are considered assets on the company's balance sheet. However, if a customer doesn't pay their bills, their account may become bad debt, which is a liability. In that case, it's no longer part of net current assets.

What is the working capital cycle?

The working capital cycle is the time it takes for a company to turn its initial investments (in raw materials or inventory, for example) into cash from customers.

Let's say a furniture company buys a supply of lumber to make its products. Payment to the supplier for those raw materials is due in 60 days. After that, it takes about 45 days for the company to manufacture its products and sell them to customers. Those customers then have 30 days to pay the furniture company for their purchases.

Working Capital Cycle = Inventory Days + Receivable Days - Payable Days

- Inventory Days (Days Inventory Outstanding): The average number of days that a company holds its inventory before selling it.

- Receivable Days (Days Sales Outstanding): The average number of days that a company takes to collect payment after making a sale.

- Payable Days (Days Payable Outstanding): The average number of days that a company takes to pay its suppliers.

Why the length of the working capital cycle matters

The best duration for the working capital cycle varies by industry and business needs.

A low or negative cycle can indicate impressive operational efficiency and a strong cash flow. However, it might also indicate that the company is struggling to meet its short-term obligations.

It depends on the bigger picture and the company's current and longer-term needs.

The most important parts of the WC cycle

It's important to optimize each part of the cycle for the best result. This could mean:

- Negotiating better terms with your vendors to improve Payable Days

- Streamlining your accounts receivable process to improve Receivable Days

- Investing in efficient manufacturing and marketing processes to improve Inventory Days

Paying close attention to each phase will help you achieve the best cycle for your business's needs.

Improving working capital

To improve your company's WC, consider the following steps:

- Keep track of your WC ratio. Close monitoring will help you identify potential areas for improvement. Always remember that, generally, a ratio of 1.5–2 is considering sound, but that a current ratio higher than 2 doesn’t always indicate strength.

- Optimize your accounting process. Incentivize customers to pay on time, minimizing the bad debt the company must write off.

- Negotiate with creditors. Find opportunities to secure better repayment terms for your investments in raw materials.

- Cut unnecessary expenses. Seek out ways to spend less money without compromising the quality of your product.

FAQs

Don't see your question answered here? Contact us today.

Why does working capital decrease?

Capital might decrease in the case of an unexpected bill, if revenue declines, or if a current asset or account receivable must be written off.

Where is working capital on the finance statement?

Working, or operational, capital can be found on the asset side of the company's balance sheet.

When is negative working capital good?

Negative operational capital can work well for companies with high inventory turnover who can move products before they need to repay their suppliers. This temporary excess of liquid cash can then be invested into the business.

What is a good working capital ratio?

According to conventional wisdom, a good working capital ratio is between 1.5 and 2. However, this varies heavily by industry.

How does working capital affect liquidity and profitability?

Working capital is a liquidity metric, so when working capital increases, liquidity increases.

As for profitability, efficient working capital management can help build a business that's more profitable in the long run. In the short term, though, it's possible that an increase in working capital can decrease profits since more resources are tied up in running the business.

Further reading

Table of contents

What is working capital? The importance of working capital Understanding working capital

Sign up in minutes.

Start saving hours.

Manage all of your payments in one platform. No jumping between apps necessary.

Start free trialGet a grip on your working capital and optimize your cash flow with Plooto

Get started for efficient, accurate, and easy AP/AR automation.

Start free trial.png)