Many people starting new businesses today don't understand how to accept credit cards. They're simply unaware of the many options available. This article explains what you need to know about accepting credit card payments.

About Credit Card Acceptance

Accepting credit card payments is relatively quick and easy. You just need to register your merchant account with the payment processor you want to use and follow a few simple steps to accept credit cards. If you are accepting credit cards in person, you can usually do it in less than five minutes.

You can consider opting for a payment service provider. Most companies offer a free trial period where you can test out the system without having to pay anything up front. Once you decide whether you like the payment service provider, you can sign up for a monthly fee that varies depending on how many transactions you make each month.

You don't have to spend hours creating forms and processing payments manually. There are plenty of ways to accept credit card payments quickly and easily. You can do it in person, over the phone, or online. And most importantly, there's no limit to how many people you can serve.

7 reasons why your business should accept credit card payments

If your business is not already taking credit or debit cards, there are several good reasons why you should consider providing this payment method. For one thing, it helps improve cash flow. In addition, card holders tend to spend more money than those who pay by cash or check. They also tend to spend more quickly.

Here are some additional benefits of accepting credit and debit cards:

1. Faster Payments

Credit and debit card transactions are processed much faster than traditional methods such as paper checks and wire transfers. You can usually receive payment within 24 hours of the purchase.

2. Better customer retention

Customers who make purchases using credit or debit cards tend to spend more than those who pay with cash or checks.

3. Improved cash flow

If you accept card payments electronically, you can improve your cash flow.

4. Increased sales

People who buy things online tend to spend more than people who shop in stores, according to a study by the National Retail Federation.

5. Lower fraud rates

Fraudsters target businesses that do not accept credit or debit cards.

6. More secure

Because your customers use digital information rather than physical documents, you reduce the risk of theft or loss.

7. Less paperwork

When you accept payments electronically, you eliminate the need to print, mail, and file receipts.

8. Improved AR turnover ratio

Giving customers options to pay you in a way that meets their needs means you're meeting them at their payment process. This means that you'll be paid faster and more easily — the perfect recipe for a healthy AR turnover ratio.

How credit card processing works

Regardless of whether you receive card payment in person or online, there are several basic steps involved in the transaction process. Here we'll go over each step of the process and what it entails.

Steps to credit card processing

-

Depending on the method used, the cardholder may swipe, insert, or tap their credit card. If a customer is shopping online they will manually enter their credit card details.

-

The payment processor communicates with the customer's financial institution to ensure certain criteria, like sufficient funds or staying within credit limit, are met to complete the transaction. The credit card processing occurs through credit card networks, which allows authorization and the transfer of funds.

-

If the card issuer approves the transaction, the processor debits the customer's account and credits our merchant account with the transaction amounts. The processor does not charge the customer directly; rather, it passes along the charges to us, the merchant.

-

The merchant keeps track of transactions and sends their bank monthly statements showing the total amount of sales processed and the average dollar amount per sale.

-

The payment processor sends debit details to the appropriate banks and deposits funds into the merchant account according to the statements.

In-person credit card transactions

For in person transactions, a point-of-sale (POS) system, or a card reader is used to collect credit card information.

The customer swipes, inserts, or taps their credit card to enter their information into the payment processing system. Some systems require cardholders to use one of those three methods.

Accept credit cards online

To accept online payments, a customer enters their credit card details into a payment processor. In some cases, cardholders must provide additional information such as name, address, phone number, email address and/or zip code. This information is usually entered manually by the customer. This process is similar to how debit card payments are made.

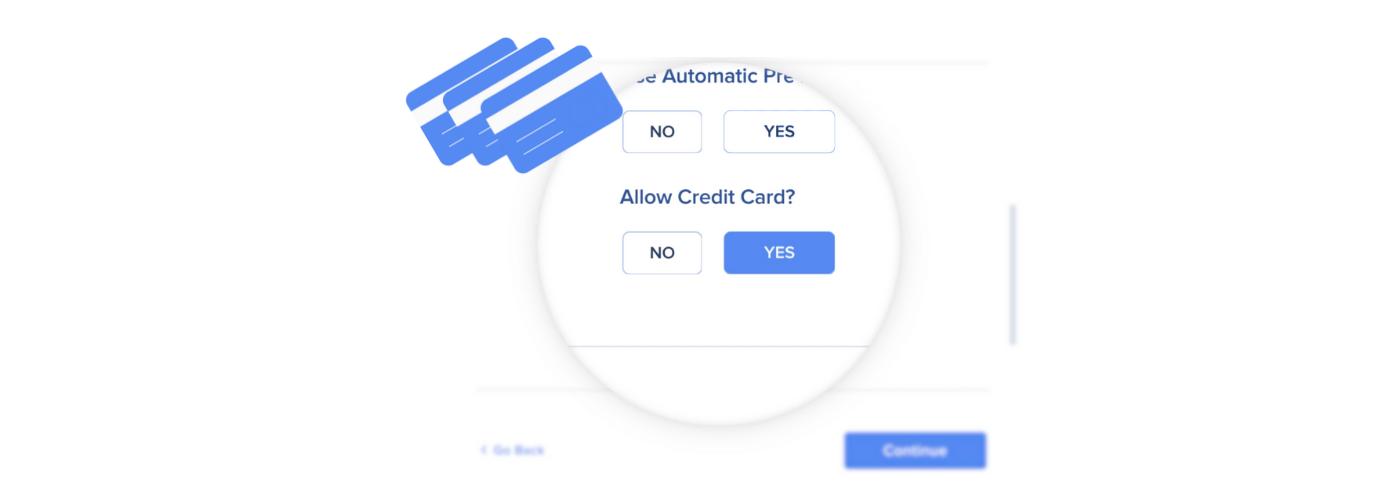

Plooto offers credit card acceptance feature in accounts receivable

Credit Card Acceptance is Plooto's newest feature in accounts receivable. Compared to the average of four to seven businesses days to accept payments via ACH, you can now get paid as soon as two business days with Credit Card Acceptance.

With Plooto, provide more payment flexibility to your customers and receive payments with a competitive, straightforward rate of 2.9% + $0.30 per transaction.

Consolidate all of your financial tools into one! Plooto is the single tool you need for your business. Unlike other credit card solutions, you can leverage workflows and automation in Plooto to streamline the entire end-to-end collections process. Get paid faster with credit cards without having to compromise the existing internal processes, making the adoption of credit cards convenient.

Frequently Asked Questions

How much are the credit card processing fees?

There is a charge of 2.9% + $0.30 per transaction.

Which credit cards are accepted to process a credit card transaction?

Mastercard® credit cards, Visa® credit cards, and American Express® credit cards are accepted.

We are working on bringing more options to serve you soon. Stay connected to know more about the upcoming updates.

Can suppliers/vendors use a prepaid gift card to make a payment?

No, Visa® Prepaid Gift Cards, Mastercard® Prepaid Gift Cards, American Express® Gift Cards are currently not accepted.

How long does it take to process a credit card transaction?

Each transaction will take at least two business days for you to see it in your bank.

Am I able to use the QuickBooks or Xero integration with credit cards?

Yes, you are still able to enjoy the two-way sync between QuickBooks, Xero, and NetSuite — automatically importing invoices and reconciling credit card transactions - making it faster to receive and manage your receivables!

Is it possible to collect recurring payments with Credit Card Acceptance feature?

Yes, you can collect recurring payments with Credit Card Acceptance.

Key takeaways

Here are seven reasons it might make sense to start accepting credit cards:

- You’ll receive immediate payment.

- Your customers will likely spend more money than they normally would.

- Credit cards allow you to offer discounts.

- They improve cash flow.

- Customers like the convenience of being able to pay online.

- You can save money on processing fees.

- And, according to Forrester Research, 70% of consumers say they prefer to use a digital channel to complete transactions.