The full guide to invoice management

Struggling to keep track of your invoices? Learn about the importance of proper invoice management and automation.

-min.png)

Managing invoices is one of the biggest pain points of operating a business. According to Skynova, nearly half of all businesses process 500 invoices per month and two-thirds spend five days or more handling them.

Companies are increasingly adopting automated invoice management systems because they value how the speed and accuracy of automation can enhance cash flow and make it more predictable.

Key takeaways:

- Invoice management is challenging for many businesses, often involving hundreds of invoices each month, taking up a lot of time and resources.

- The manual process involves many steps and personnel, making it slow and prone to errors.

- A detailed approval process helps find errors but can slow down B2B payments, especially if corrections are needed.

- Companies are turning to automated systems to improve efficiency, cash flow, and accuracy, speeding up processing.

- Advanced invoice management systems use automation, digital storage, and payment tracking to reduce manual work and error risk — saving lots of time and resources.

- These systems improve cash flow visibility, cut down on errors, and enhance vendor relationships by ensuring on-time payments.

What is invoice management?

Invoice management is the process of receiving, tracking, and paying invoices from a vendor or supplier. For most businesses, this is a multi-step process that includes:

- Receiving the invoice and forwarding it to the right department

- Ensuring that the invoice is accurate and legitimate

- Sending payment to the vendor or supplier

- Recording the transaction in your accounting software

Often, an invoice is handled by multiple parties, because the employee who purchased a product or service may not be the one who makes payments. One or more members of your accounts payable team may need to be involved in the payment process.

Having a thorough invoice approval process helps you identify errors and avoid making duplicate payments, but it can also lead to payment delays as an invoice moves through the accounts payable process. It can take even longer if there’s an error and you need to ask the vendor to re-issue the invoice before making a payment.

What is an invoice management system?

An invoice management system refers to the software that a business uses to digitize and streamline the invoicing process. A good invoice management solution can process both physical and digital invoices, and tends to include these key features:

Automation

Instead of manual invoice processing, businesses can use invoice automation software to track and validate supplier invoices. From using optical character recognition (OCR) tools to read paper invoices, to scanning and processing email attachments, using an invoice management system reduces the need for manual data entry.

Digital storage

Rather than storing historical invoice data in a spreadsheet (or paper invoices in a filing cabinet), invoice management tools allow you to store digital invoices in a centralized, cloud-based database. This makes it easy to look up invoices for review later, and to save a copy of any invoice for your business records.

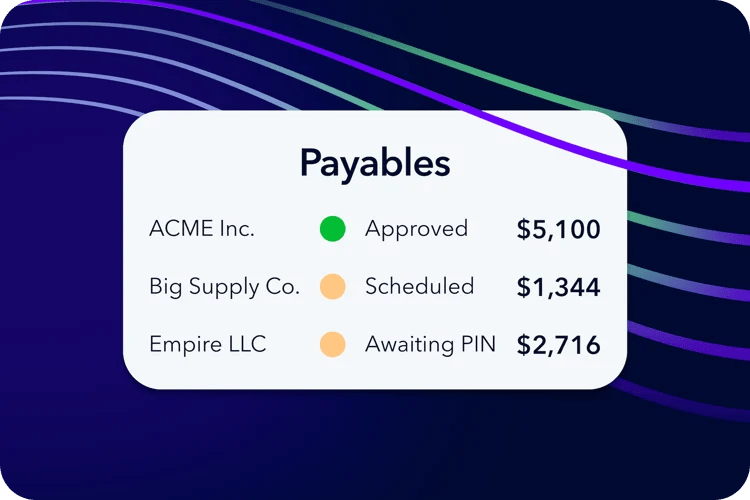

Payment tracking

Invoice management platforms can also streamline the payment process by integrating with other parts of your accounts payable system. You can make payments to vendors electronically, match payments with invoices and purchase orders, and automatically import the transaction into your accounting software.

The importance of invoice management

Why is effective invoice management important? Here are three key ways that invoice management tools can have an impact on your business operations:

Reduced errors

First, having a system in place for managing invoices reduces the risk of human error in the invoicing process. These mistakes can range from a vendor sending you a reminder for an invoice that you’ve already paid, to an employee entering the wrong number into your accounting software. Invoice management software helps you confirm the validity of each invoice and avoid making duplicate payments.

Improved cash flow

Second, an invoice management system gives you greater visibility into the status of all upcoming payments and outstanding invoices, and greater control over your cash flow. Schedule payments in advance to ensure that you always have enough cash on hand and avoid overdue invoices and late fees. With improved cash flow clarity, you can make better strategic decisions that help you grow your business.

Better vendor relationships

Finally, invoice management helps you maintain positive relationships with vendors. Get discounts for making early payments, streamline the procurement process for upcoming purchases, and avoid the embarrassment of late payments. Making on-time payments and responding to new invoices promptly helps you build trust with your suppliers.

The major challenges of invoice management

An inefficient invoice management system can pose some challenges, from the time it takes to process invoices to late or duplicate payments. Here are a few of the biggest pain points businesses experience when processing large volumes of invoices:

Invoice processing takes time and effort

As we saw earlier, some businesses spend five days per month processing invoices — which is time and energy that could be better spent on other business activities. Even a single invoice can take days or weeks to go through the invoice management process, especially if multiple employees are needed to review and approve it.

Late payments can damage your reputation

Paying invoices promptly can help you maintain your credibility with vendors and show that you’re a reliable company to do business with. Late payments and unpaid invoices don’t just hurt your reputation — they can also hurt your bottom line as vendors charge late fees or penalties, or request upfront payment for future purchases.

Invoice errors can impede record-keeping

Maintaining accurate records is important, and failing to track and process each invoice promptly can lead to mistakes in your accounting software. If you’re ever subject to an audit or investigation, you may need to provide invoices and receipts to back up your business records, and an error-prone filing system can get in the way of that.

Cash flow challenges

Knowing the status of all of your incoming and outgoing payments is key to maintaining enough cash flow to operate your business. Without a centralized invoice management system, you may struggle to keep track of upcoming due dates, and which payment is due to which vendor. This increases the risk of late or overdue payments, or even the unfortunate scenario of paying the same invoice twice.

Different types of invoices

There are many different types of invoices, each with their own purpose. Here are some of the types of invoices you might send or receive:

Proforma invoice

A proforma invoice is an estimated invoice that’s sent before a vendor supplies goods or services.

Interim invoice

An interim invoice is a partial invoice sent upon the completion of a milestone in order to spread out payments over the course of a project.

Final invoice

A final invoice is sent after the completion of a project or service that includes an itemized list of goods and services provided.

Recurring invoice

A recurring invoice is one that’s sent on a regular basis for ongoing services, such as accounting or IT services.

Debit invoice

A debit invoice is used to adjust a bill a vendor has already sent you, for example, if they had to work additional hours.

Credit invoice

A credit invoice is used to record overpayments or adjustments that result in the vendor owing you a balance credit or refund.

Collective invoice

A collective invoice compiles the amount owed for multiple products or services onto a single invoice.

How has invoice management evolved?

Invoice management has evolved from a paper-based manual process to one that’s easily digitized and automated. Historically, businesses relied on paper invoices and receipts that had to be sent through the mail and recorded in physical spreadsheets. These invoices had to be filled out and processed manually.

Invoice management became increasingly digitized, with the arrival of optical character recognition (OCR) tools in the 1970s and 80s. These tools allowed businesses to scan and process invoices digitally and store accounting records electronically.

These days, the growth of automation and artificial intelligence (AI) promises to take invoice management even further, with tools that can process invoices automatically and identify errors and discrepancies. One study found that the use of these tools “increased productivity by 33% and reduced processing costs by 42%.”

Automated vs. manual invoice processing

There are two main ways for businesses to manage invoices. The traditional approach is to process them manually, by having one or more employees review and pay each invoice individually. The other is to use automated invoice management software to process them electronically, with significantly less human intervention.

According to global e-invoicing market statistics, “only 9% of all AP departments use a fully automated accounting process.” But as many as “64% of these businesses are increasing the volume of their e-invoicing system” and “77% of all accounts payable departments are now involving some kind of automation” in the invoice management process.

The manual invoice management process

- An employee receives the invoice from a supplier.

- The employee enters the invoice into your system, either by scanning a paper document or copying the information from an email or file attachment.

- The invoice is forwarded to your accounts payable team for review.

- Your AP team verifies and approves the invoice.

- Your AP team makes and records the payment.

- The supplier sends a receipt, which you file away in your records.

What are the drawbacks of manual invoice processing?

Manual invoice processing comes with an increased risk of mistakes and inefficiencies. Errors can turn up at any point in the process, from an employee entering in the wrong payment amount or vendor information to your AP team failing to approve an invoice in a timely manner. Not only that, but you can end up with errors and omissions in your financial records, especially if you rely heavily on paper invoices and receipts.

What is automated invoice management?

Automate invoice management removes some of these inefficiencies by streamlining the invoice management process. Although each invoice will move through the same steps, your invoicing software will do most of the work for you. For example:

Your invoicing software will automatically convert scanned documents or file attachments into a useable file format

Team members get automatic notifications and reminders when they need to review an invoice or make a payment

Payments are automatically recorded in your accounting software, reducing the need for manual data entry

Alongside other AP automation tools, automated invoice management can save time, lower costs, and increase transparency across your accounting department.

It can also improve vital cash flow metrics like AR turnover, AP turnover, cost per invoice processed, days sales outstanding, vendor compliance rates, and more.

Where manual and automated invoice management differ

|

Manual |

Automated |

|

|

Data entry |

Involves hands-on, direct data entry |

Uses OCR technology for automatic data entry |

|

Invoice tracking |

Invoices are organized in physical folders or basic digital systems |

Uses software built for real-time invoice tracking |

|

Approval process |

Approvals are obtained through manual document circulation |

Faster approvals using digital workflows |

|

Payment processing |

Payments are made and recorded by hand |

Processes payments automatically, making them faster and more accurate |

|

Dispute resolution |

Disputes are resolved through personal communication |

Automates the identification and resolution of discrepancies |

|

Archiving |

Invoices are stored in physical files or simple digital formats |

Uses digital storage solutions that are searchable and efficient |

|

Compliance and auditing |

Compliance is ensured through manual checks and audits |

Automatically performs compliance checks and creates audit trails |

Automated invoice management software

Automated invoice management software platforms vary in terms of cost and features. Here are a few examples of invoice management software to choose from:

Plooto

Plooto is an invoice management platform that allows you to import, manage, and pay all of your paper and electronic invoices from a single platform. Plooto supports online checks and international payments, and will automatically reconcile your invoices with accounting software like Quickbooks and Xero.

Plooto offers a 30-day free trial, and pricing options start at $32 per month for small businesses and $499/month for businesses with more complex needs.

Bill.com

Bill.com is an online invoice management platform aimed at corporate businesses and accountants. It provides users with an inbox, custom approval policies, and document storage, as well as integrations with Quickbooks and Xero.

Freshbooks

Freshbooks is an online accounting tool for small businesses and freelancers. Although it’s primarily focused on sending invoices to clients, you can use it to track bills and outgoing payments, reconcile your accounts, and save receipts.

How to choose the right invoicing software

The right invoice management software for you will depend on the size of your business and what features you want it to have. Ask yourself these questions to get started:

Pricing: How much does it cost and what are its pricing options? Most platforms charge a monthly rate per business or per user, but there may be additional fees associated with making or receiving payments.

Ease of use: How easy is it to use? Consider whether the platform provides live chat, phone, or email support if you need help along the way.

Integrations: Does the platform integrate with other tools you already use? For example, Plooto integrates with Quickbooks, Xero, and Oracle NetSuite, so you can easily keep records consistent across multiple accounting tools.

Security: How safe and secure is it? Make sure it provides advanced security features such as data encryption and two-factor authentication.

FAQs

Don't see your question answered here? Contact us today.

What is an invoice?

An invoice is a document sent by a seller to a buyer that details a transaction and requests payment. Invoices list the products or services provided, their prices, and the total amount owed. The purpose of an invoice is to clearly outline the payment the buyer owes to the seller, ensuring both accurate record-keeping and timely payment.

How do I reduce invoice errors?

Reduce invoice errors by using a consistent numbering system to identify invoices, and use invoice management software to process invoices from vendors.

What are the five uses of an invoice?

The purpose of an invoice is to:

1. Initiate a request for payment

2. Track sales and services

3. Maintain accurate records

4. Monitor inventory and cash flow

5. File and collect applicable taxes

What should a good invoice include?

A good invoice should include:

• An invoice number

• The date of issue and due date

• The name of the client or customer

• The name of the vendor or supplier

• An itemized list of goods and services provided

• The total amount owed and how to pay it

What program is best for invoices?

The best program for generating invoices depends on the needs of your business. A small business can use invoice templates to generate invoices manually, but a larger business should use invoicing software to manage high volumes of invoices.

Is Word or Excel better for invoices?

Microsoft Word is fine for simple invoices, but Excel is better for complex invoices since it can add up sums automatically. If you generate a lot of invoices, you can use invoice management software like Plooto to generate and track invoices automatically.

Related resources

Table of contents

What is invoice management?

What is invoice management?

What's an invoice management system?

What's an invoice management system?

The importance of invoice management

The importance of invoice management

Major challenges

Major challenges

Different types of invoices

Different types of invoices

How invoice management has evolved

How invoice management has evolved

Automated vs. manual invoice processing

Automated vs. manual invoice processing

Automated invoice management software

Automated invoice management software

FAQs

FAQs

Sign up in minutes.

Start saving hours.

Manage all of your payments in one platform. No jumping between apps necessary.

Start free trialMake your invoice management perfect with Plooto Capture and our all-in-on AR/AP automation solution

Get started for free with Plooto to make all your payment processes stree-free and secure.

Start free trial

.png)